Sharia Compliant Will Writing Service: Protect Your Legacy by Islamic Law

A Sharia-compliant law will ensure that Islamic inheritance law is followed. In the UAE, Sharia law governs asset distribution for Muslims. Drafting a Sharia-compliant will ensures proper asset allocation. A Sharia-compliant will in Dubai allows the appointment of guardians for minor children. Guardianship ensures children’s upbringing follows Islamic teachings.

Sharia law inheritance in the UAE is crucial for distributing wealth among Muslims, ensuring compliance with Islamic principles. In the UAE, where many residents, including expats, are Muslim, local estate planning and succession planning align with Sharia law. A Sharia-compliant succession planning protects family interests and ensures fair distribution according to religious guidelines. Islamic inheritance law, or Faraid, outlines equitable wealth distribution among heirs, safeguarding the financial rights of spouses, children, and other relatives as prescribed by the Quran.

If Muslims in the UAE do not have a Sharia law-compliant will, the default laws may complicate the distribution of their assets. Creating such a will is vital for estate management and family protection. Muslims must create a Sharia-compliant will to fulfill religious obligations, providing clarity and protection for heirs.

What is a Sharia-compliant will?

A Sharia-compliant will is a document prepared under Islamic inheritance rules in which a person’s assets are distributed according to the teachings of the Quran.

Sharia wills are governed by the UAE Personal Status Law 2005 in the UAE legal framework.

According to the Holy Quran’s “Islamic Law of Inheritance” every Muslim should make a will (wasiyyah) to distribute their property after death according to Sharia law.

As per the Sharia will rule in the UAE,

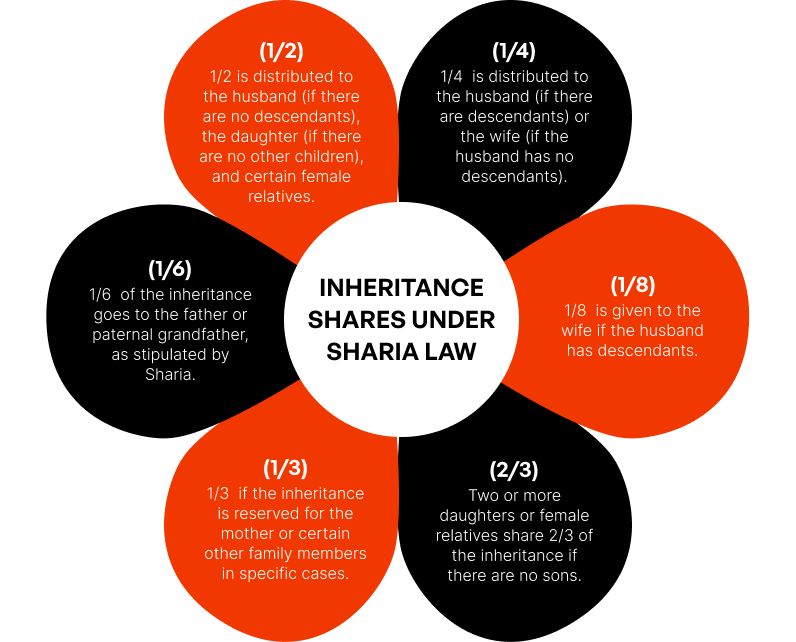

- Spouses receive 1/8 or 1/4 of the estate.

- Sons receive twice the share of daughters

- Other relatives like parents and siblings also have fixed shares.

Requirements for Shariah Compliant Will

The testator must be a Muslim

The Testator, Trustees, and Executors must be at least 21 years of age

Why is a Sharia Will Essential for Muslims in UAE?

Religious Consideration

Muslims are predominantly encouraged to write a will if they have assets to bequeath. By writing a Sharia-compliant will a Muslim’s estate is distributed according to Islamic principles.

1

Appoints Guardians for Children

Sharia-compliant will allow Muslims to choose guardians for minor children. These guardians raised these children according to Islamic teachings.

2

Compliance with sharia law inheritance

According to the distribution rules of Islamic succession, the will guarantees that a minimum of two-thirds of the estate is left to living family members.

3

Charitable Contributions

Up to one-third of the estate can be left to those not entitled to a fixed share, such as charities or friends.

4

Protection for Heirs

A properly drafted Sharia-compliant will give protection for heirs under Islamic law. Default law will apply if they don’t have a Sharia-compliant will.

5

Smooth Probate Process

A clear Sharia-compliant will expedite the probate process. It reduces conflicts among family members and ensures access to assets on time.

6

Assets may be frozen

The consequence of not having a compliant will is that your assets can be frozen until the court issues an order related to asset distribution.

7

Peace of Mind

By drafting a Sharia-compliant will, Muslims have peace of mind that their assets will be distributed after death according to their wishes.

8

How Islamic Inheritance is Managed under Sharia Law

Islamic inheritance also known as Mīrāth is an important component of Sharia Law that is also known as “ilm al-farāʾiḍ” (the science of set shares).

Governing Laws of Inheritance

Sharia Law serves as the primary foundation for inheritance laws in the UAE. The key laws that regulate inheritance include:

- Federal Law Number 5 of 1985 concerning the Civil Transactions Code (Civil Law)

- Federal Law Number 28 of 2005 regarding the Personal Status Law (Personal Law)

Article 1(2) of the Personal Law specifies that UAE law applies to all citizens, except non-Muslims, who may choose their own country’s laws. Article 17 of the Civil Law governs inheritance by the deceased’s nationality at the time of death.

Key Characteristics

Four tasks must be done after the death of a Muslim.

Payment of funeral costs

Settling of debts

Execution of the deceased’s will

Distribution of the remaining estate according to Sharia law

Heirs Under Sharia Law

In Islamic inheritance, the heirs include family members such as:

Spouse, parents, children, siblings, and other direct descendants.

Illegitimate or adopted children are not considered heirs.

Non-Muslims cannot inherit from a Muslim’s estate.

A person who murders to benefit from the estate is ineligible.

The court verifies the heirs through male witnesses and documentary proof of compliance with Sharia principles.

Division of Estate

Here is the estate according to Islamic inheritance law

Sharia law also dictates that the estate first covers the deceased’s debts and funeral expenses before distribution among heirs.

| Inheritance Distribution |

|---|

|

| Restrictions on Wills |

| Following Sharia law, a testator can only bequeath up to one-third of their estate to non-heirs in a will. The remaining portion must be distributed among specific heirs as prescribed by Islamic inheritance laws. Any bequest beyond the one-third limit requires the consent of the legal heirs to be valid. This ensures fairness and adherence to Sharia principles in estate distribution. |

| Exclusions |

Certain individuals can not receive any fixed share in the inheritance, including;

|

| Validation |

| The distribution process requires validation by UAE courts to comply with Sharia law. |

Where Can You Register Your Sharia Wills in UAE?

In the UAE, you can register your Sharia wills with

Abu Dhabi Judicial Department (ADJD)

Testators can also register their Sharia Wills in Abu Dhabi with the Abu Dhabi Judicial Department (ADJD). The ADJD operates under Civil law and gives peace of mind to testators and beneficiaries. For those residing in Abu Dhabi, Abu Dhabi Judicial Department Wills might be applicable.

Dubai Courts

Testators can register their wills in compliance with the Personal Status Law under Dubai Courts. Dubai courts operate under Sharia law.

What Documents Are Required for Sharia Wills Registration?

- Proof of age: Must be 18 years old or older.

- Proof of identity (such as an Emirates ID).

- Proof of mental capacity: Must have the mental capacity to make a Will.

- Written Will: A written document (spoken declarations are accepted).

- Declaration: A statement confirming that the testator wrote the Will.

- Last Will declaration: Confirmation that this is the final Will and invalidates previous Wills.

- Witness signatures: The Will must be signed in the presence of two witnesses, who cannot be the testator’s spouse or beneficiaries.

- Any relevant documents about assets being bequeathed (e.g., property titles).

How Juriszone Helps You Draft a Sharia-Compliant Will

Juriszone helps you draft a Sharia-compliant will according to Islamic Inheritance laws. Their Will Registration service for Muslims includes:

Free Consultation

Juris Zone provides free consultation to draft a Sharia-compliant will under Sharia law in the UAE. We understand all rights and obligations to distribute assets and can properly guide the individuals.

Fast and Easy Compliant Will Drafting

Our experts make the will drafting process quick and efficient in compliance with Islamic Inheritance laws. The will must be written in English and Arabic.

Executor Appointment

Juriszone will appoint trusted executors for your will and carry out your wishes They will manage the registration process and make the probate process easy after death.

Witness Arrangement

Juriszone will arrange the witness and ensure the will is properly drafted, signed, and valid.

Secure storage of wills

Your will is securely stored, protecting it from loss, damage, or theft. Only accessible when needed for the execution of your wishes.

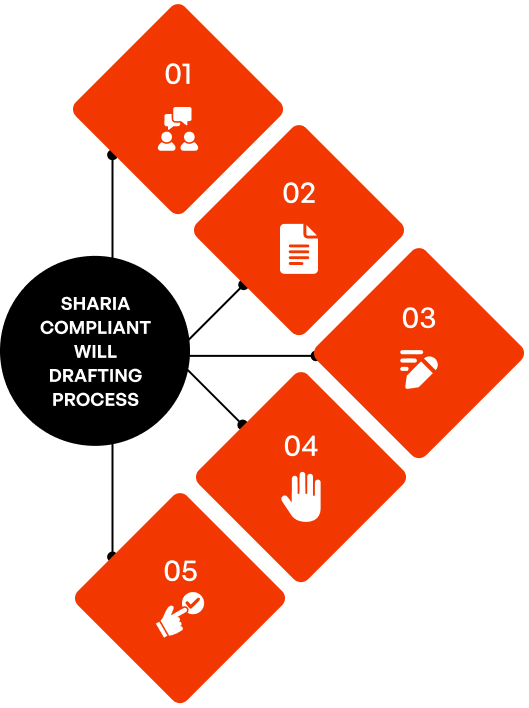

Steps to Create Wills for muslims in Dubai

Creating a Sharia wills and succession planning involve several key steps

Consultation

The first step to drafting a Sharia-compliant will is to consult an expert in will writing services in UAE who knows Islamic inheritance laws and understands the religious obligations.

1

Gather Necessary Documents

For will drafting you should have all relevant documents related to your assets and beneficiaries.

2

Will Drafting

The next step is to draft a will when you have all the documents. The will is written in Arabic or English. You can draft your will according to Islamic principles and personal wishes. Check out sample will template

3

Witnessing Requirements

According to Islamic laws, you can write a will in the presence of at least two eligible witnesses. A witness can not be the testator’s spouse or beneficiary of the will.

4

Registration

Finally, submit your signed will to the authority for registration to ensure its validity. .

5

Witness Requirements for Sharia-Compliant Wills

Importance of witness

For the execution of a Sharia-compliant will there must be a witness. Their presence validates the will and provides support in case of disputes.

Witness Criteria

- A Sharia-compliant will be signed in the presence of two witnesses.

- The witness should be qualified and can check the will is valid.

Witnesses cannot be:

- The spouse of the testator.

- Beneficiaries of the will.

Formalities for Sharia-Compliant Wills

To create an Islamic will it must meet the following conditions:

- The testator must be 18 years or older.

- The testator must have the mental capacity to make a will.

- The will must be in writing (verbal declarations are not accepted).

- The testator must declare that the will is their last will.

- The will must be signed in the presence of two witnesses.

Considerations for Executors

- The executor (or wasi) must be a Muslim.

- A disabled woman or a person can also be an executor.

Understanding the Probate Process for Sharia-Compliant Wills in the UAE

The probate process for Sharia-compliant wills involves several stages:

![]()

Validation by Courts

1

After death, the registered will be presented before local courts for validation.

![]()

Asset Inventory

2

An inventory of all assets must be compiled and assessed by executors appointed in the will.

![]()

Distribution According to Will

3

Once the will is approved, the assets are given out based on the instructions in the will, while also following the fixed shares set by Islamic law.

![]()

Resolution of Disputes

4

If disputes arise among heirs regarding asset distribution or interpretation of the will, they may need to be resolved through courts.

Key Considerations When Drafting a Sharia-Compliant Will

Guardianship for Minor Children

Appoint guardians for minor children who can take custody of your children and take care of them according to Islamic principles. The guardian must be 21 years or older. A female guardian must be appointed for a girl child.

Fixed Inheritance Shares

- Sharia law predetermines fixed shares for family members, such as parents, children, and spouses.

- Male children typically receive twice the share of female children.

Distribution of Estate

- Two-thirds of the estate must be distributed to heirs based on Sharia inheritance laws.

- One-third of the estate can be bequeathed to non-family members, non-Muslims, charities, or organizations.

Exclusion of Heirs

A testator cannot exclude an heir unless the heir consents to the exclusion.

Debts and Financial Obligations

All debts must be paid before distributing the estate. The one-third portion is calculated after debts are settled.

Executor Appointment

The executor (wasi) must be a Muslim, and there are no restrictions based on gender or disability.