11 Essential things involved in Registration of Will in UAE

Will registration in Dubai: Find out how to secure your family legacy

Registration of will in the UAE requires careful attention to its structural components, especially for expatriates managing dual legal frameworks.

Whether you are a non-Muslim who enjoys full flexibility asset allocation or a Muslim whose estate follows shariah compliant succession planning, understanding the key sections of will drafting in UAE is essential.

The importance of will registration cannot be ignored.

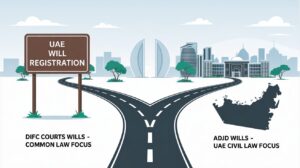

This guide offers an overview of will registration in UAE, detailing each component, its purpose, and the legal implications under UAE inheritance laws, including options like DIFC and ADJD wills. It provides essential insights to help you draft a legally compliant will that reflects your personal wishes.

- Structured Clarity: Each section of your will serves a distinct purpose, ensuring that your instructions are clear.

- Jurisdiction Matters: Choosing between DIFC and ADJD wills affects asset flexibility, language, fees, and territorial coverage.

- Detailed Asset Distribution: Clearly defining how assets are allocated helps prevent disputes.

- Legal Authority: Explicitly granting powers to executors and trustees allows for efficient estate management.

- Future Guardianship: Appointing clear guardians for minor children protects their welfare.

- Compliance: Adhering to legal execution and attestation requirements guarantees your will is enforceable.

Introduction

A structured will is vital for safeguarding your legacy, ensuring asset protection, and providing executor clarity for efficient estate administration. In the UAE, estate planning involves unique challenges because of the coexistence of civil law and Sharia principles. For expatriates and residents alike, it is important to know:

Asset Protection:

How your assets are legally passed on to beneficiaries. Sharia compliance mandates that Muslims can only freely allocate up to one-third of their estate. At the same time, non-Muslims enjoy full testamentary freedom to distribute their assets as per their wish..

Executor Clarity:

Clear guidelines for those tasked with administering your estate.

Jurisdictional Differences

Choosing between DIFC Wills (for non-Muslims) and ADJD Wills (for Muslims and non-Muslims) affects estate execution.

Expatriate Considerations:

Dual legal systems may affect your will if you hold assets within and outside the UAE.

Declaration

The declaration confirms your identity and intent, establishing the will as your final testament and eliminating any ambiguity regarding the document’s legitimacy while affirming that you are creating the will voluntarily.

What It Covers:

- Testator Eligibility:

- You must be at least 21 years old and mentally competent.

- Legal ownership of the assets is confirmed.

- Final Testament Statement:

- Declares that the document is your last will and testament.

- Revocation Clause:

- Explicitly revokes any previous wills.

- Sharia Compliance (for Muslims):

- Only one-third of the estate may be allocated at your discretion, with the remaining two-thirds distributed according to fixed heirship rules.

Appointment of Executors of Will and Trustees

Executor of a will definition: Will executor are responsible for managing your estate and ensuring that your wishes are followed. Trustees may be appointed for long-term asset management, particularly if your will establishes a trust for minor beneficiaries.

Key Considerations:

- Mandatory Appointments:

- Under DIFC rules, the appointment of an executor and trustee is mandatory.

- Under ADJD, while naming executors is required, appointing trustees is optional.

- Responsibilities:

- Settling outstanding debts.

- Valuing and managing assets.

- Ensuring the will’s instructions are implemented.

- Multiple Appointments:

- It is advisable to name primary and alternate executors to prevent delays in estate administration.

- Witnesses:

- Two witnesses are mandatory in the DIFC Courts Wills

- Witnesses are not required for ADJD Wils

Debts and Funeral Expenses

Before distributing your assets, settle any debts and set aside funds for funeral expenses. This prevents conflicts among beneficiaries and protects the estate’s integrity, ensuring they receive their intended inheritance without unresolved obligations.

What to Address:

- Debt Repayment:

- Specify that any outstanding debts or liabilities must be cleared before the estate is distributed.

- This provision is often enforced by UAE courts to prevent disputes.

- Funeral Arrangements:

- Allocate specific funds for funeral or burial costs.

- Since wills are sometimes read after funeral arrangements have been made, it’s wise to inform your family of your wishes separately as well.

Letter of Wishes

A letter of wishes is a supplementary, non-binding document that offers guidance to your executors and trustees regarding personal preferences that might not be legally enforceable.

Although not legally binding, this letter helps prevent misunderstandings and can make the administration of your will smoother.

Possible Inclusions:

- Guardianship Preferences:

- Indicate your preferred guardian for any minor children.

- Asset Distribution:

- Provide insights on how you would like certain assets managed or divided.

- Charitable Donations:

- Include any instructions for supporting charitable causes.

- Personal Messages:

- Offer guidance and personal sentiments that reflect your values.

Get Free Consultation: Discuss Pricing Today!

Jurisdiction

Your choice of jurisdiction plays a pivotal role in how your will is executed, especially for expatriates. Two main options exist in the UAE:

DIFC Wills

- Applicability:

- Available to non-Muslims only, offering complete freedom to allocate assets.

- Language:

- Typically drafted in English.

- Asset Flexibility:

- Allows 100% testamentary freedom in asset distribution.

- Court Fees:

- Generally range from AED 5,000 to AED 15,000.

- Coverage:

- Can apply to both UAE-based and global assets, depending on circumstances.

ADJD Wills

- Applicability:

- Available to both Muslims and non-Muslims.Language:

- Generally drafted in English and Arabic.

- Asset Flexibility:

- For Muslims, one-third of the estate is free for discretionary allocation.

- Fees:

- Typically lower, ranging from AED 950 to AED 1,900.

- Coverage:

- Primarily focuses on assets within the UAE.

Entitlements of Insurance Proceeds

Insurance payouts can be a major component of your estate plan. Whether these funds are distributed directly or included in the general estate can influence how quickly your beneficiaries receive them.

Clear instructions regarding insurance proceeds help prevent disputes and ensure that funds are allocated as you intend.

Points to Consider:

- Direct Beneficiary Designation:

- If you name beneficiaries directly on your insurance policy, these proceeds can bypass the probate process.

- Inclusion in the Estate:

- If insurance proceeds are not specifically assigned, they become part of your overall estate and are subject to the same distribution rules.

- For Muslims, unassigned proceeds must follow Sharia law.

Distribution of Estate Proceeds

Arguably the most critical section, this part details how your assets will be divided among your beneficiaries. Detailing the distribution process with clarity reduces ambiguity and minimizes the potential for disputes among heirs.

What to Include:

- Identification of Beneficiaries:

- List full names and relationships of those receiving assets.

- Allocation Methods:

- Specify whether gifts are fixed amounts or percentages (e.g., “50% to spouse, 50% to children”).

- Non-Muslim Considerations:

- Non-Muslims can allocate 100% of their assets as desired.

- Muslim Considerations:

- For Muslims, only up to one-third of the estate can be distributed freely; the remainder follows predetermined heirship rules if the legal heirs exercise their rights under Sharia.

- Contingency Plans:

- Include alternate beneficiaries in case a primary beneficiary predeceases you.

Powers of Will Executors and Trustees

For your will to be effective, your appointed executors of will and trustees must have clear legal authority to manage and distribute your assets.

Defining these powers explicitly ensures that your estate can be administered efficiently and according to your wishes.

Key Powers Include:

- Asset Management:

- The ability to access, sell, or transfer assets.

- Debt Settlement:

- Authority to liquidate assets if needed to pay off debts.

- Dispute Resolution:

- Empowerment to make decisions if unforeseen circumstances arise, such as the death of a beneficiary.

- Trust Administration:

- Specific instructions for managing any trusts established within the will.

Guardianship Appointments

For expatriate parents with minor children, appointing a guardian in your will is essential. Clear guardianship instructions ensure your children are cared for according to your wishes.

This section provides instructions to ensure your child’s welfare in your absence.

What to Include:

- Interim Guardians:

- Temporary custodians who can care for your children immediately after your passing until a permanent guardian is established.

- Definitive Guardians:

- The permanent guardian(s) designated to care for your child.

- Trustee Roles:

- Clarify whether the guardian is also responsible for managing any assets allocated for your child.

- Legal Requirements:

- Although surviving parents usually retain custody, a will can specify exceptions to avoid potential legal disputes.

Funeral Wishes

Specifying funeral preferences ensures your wishes are respected and prevents uncertainty among loved ones.

Clearly outlining funeral wishes helps prevent disputes and ensures your final arrangements align with personal and religious beliefs.

What to Address:

- Burial or Cremation Preferences: Clearly state whether you prefer burial or cremation, along with the desired location.

- Religious or Cultural Rites: Specify any religious or cultural rituals you wish to be performed.

- Funding Arrangements: Allocate specific funds for funeral expenses to prevent financial burdens on your family.

Execution and Attestation

For your will to be legally valid in the UAE, it must adhere to strict execution and attestation guidelines.

Essential Elements:

- Written Format:

- The will must be in writing, as oral wills are not legally accepted.

- Signature:

- Your signature confirms your agreement with the contents of the document.

- Witness Requirements:

- DIFC Wills: Typically require two independent adult witnesses to sign the document.

- ADJD Wills: May not require witness signatures, though other formalities must be observed.

- Notarization and Registration:

- Depending on the chosen jurisdiction, you may need to register your will with the DIFC Wills Service Centre, ADJD, or another relevant court. This step adds an extra layer of legal security.

Following these formalities is crucial to ensuring that your will is recognized and enforceable by UAE courts.

Will Registration Expert in Dubai at your service

A well-drafted will in the UAE is more than a legal document—it is a vital tool for protecting your legacy and ensuring the welfare of your loved ones. By carefully addressing each section—from the declaration and executor appointments to the distribution of estate proceeds and execution formalities—you create a comprehensive roadmap that guides the administration of your estate.

For personalized guidance and professional support, consider consulting will registration lawyers like Juriszone who specialize in UAE estate planning. Juriszone’s Will Registration Services offer step-by-step support to help you draft a legally compliant will that meets your needs. Wondering how much does it cost to make a will in Dubai? Click to find out

Need help drafting your will? Explore our will registration services to ensure your wishes are documented accurately and legally. Additionally, check out some sample will templates to aid your understanding.