Importance of Will Registration

Is will registration compulsory? Yes, read on to know why

Importance of will registration in the UAE: What the 75% unregistered statistic means for your legacy

Have you ever considered what might happen to your hard-earned assets after you are gone? In the UAE, will registration isn’t just a formality—it’s a vital step in securing your legacy and protecting your loved ones’ future.

-

Override Default Sharia Inheritance Laws

-

Secure Guardianship for Minor Children

-

Prevent Bank Account Freezing

-

Avoid Family Disputes Over Inheritance

-

Speed Up Probate and Lower Legal Costs

-

Ensure Your Assets Go to Intended Beneficiaries

Table of Content

- Why will registration matters

- The Five Most Important Reasons to Register a Will in the UAE

- 1. Overriding Default Sharia Inheritance Rules

- 2. Securing Guardianship of Minor Children

- 3. Avoiding Asset Freezing and Financial Hardship

- 4. Preventing Family Disputes and Legal Battles

- 5. Streamlining Probate and Reducing Costs

- The benefits of registering a will

- Real-world implications and insights

- Frequently asked questions

Why will registration matters

Registering your will provides clarity and legal protection, safeguarding against potential disputes and complications. In the UAE, legally registering your will:

– Confirms the testator’s intentions, ensuring assets are distributed according to their wishes

– Significantly reduces the risk of family disputes over inheritance

– Provides a clear legal framework that streamlines the probate process

– Secures your legacy by legally protecting your beneficiaries’ interests

According to the UAE’s Official Portal, about 75% of UAE residents don’t have not registered their a will. This statistic underscores the importance of understanding and acting on will registration.

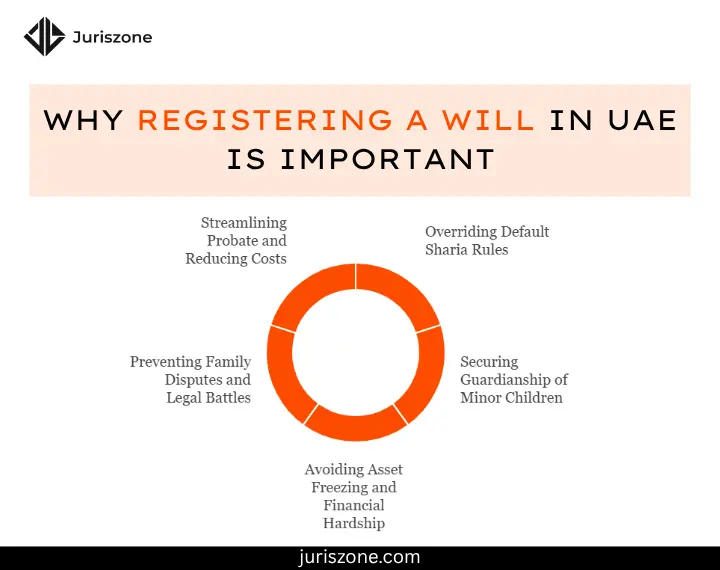

The Five Most Important Reasons to Register a Will in the UAE

Why Registering a Will in UAE is Important

Why Registering a Will in UAE is Important

- Protects your assets and ensures they are distributed according to your wishes.

- Provides guardianship arrangements for minors.

- Avoids inheritance disputes by clearly stating beneficiaries.

- Complies with UAE laws for both Muslim and non-Muslim expats.

The UAE’s legal system enforces Sharia inheritance laws by default, which can disrupt expats’ estate plans. Without a registered will, assets may be distributed against personal wishes, excluding unmarried partners, stepchildren, and non-relatives.

Here are five key reasons expatriates should register a will in the UAE.

1. Overriding Default Sharia Inheritance Rules

- Preserving Testamentary Freedom: UAE intestacy laws allocate fixed shares based on Sharia principles, limiting a spouse’s share to 1/8 and granting sons twice the inheritance of daughters. A registered will ensures assets pass to chosen beneficiaries.

- Avoiding Cross-Jurisdictional Conflicts: Expats with assets in multiple countries risk fragmented succession if relying on foreign wills. A UAE-registered will prevents local assets from defaulting to Sharia-based distribution.

2. Securing Guardianship of Minor Children

- Preventing Court-Appointed Guardianship: UAE law assigns guardianship to the closest male relative of the paternal side if both parents die intestate. A DIFC Guardianship Will allows expats to appoint preferred guardians, avoiding forced custody decisions.

- Addressing Visa Cancellation Risks: Residency visas for dependents expire within 30 days of the primary holder’s death. A will ensures temporary guardianship provisions, preventing immediate displacement.

3. Avoiding Asset Freezing and Financial Hardship

- Immediate Access to Funds: UAE banks freeze accounts upon death, including joint accounts, until a succession certificate is issued. DIFC wills expedite probate, granting access to funds within weeks instead of months.

- Real Estate and Business Continuity: Intestacy often forces property sales to meet Sharia-mandated distribution. A DIFC Property Will allows seamless asset transfer, protecting rental income and business operations.

Get Free Consultation: Discuss Pricing Today!

4. Preventing Family Disputes and Legal Battles

- Reducing Litigation Risks: Inheritance disputes among expats increased by 37% in 2023, with cases averaging 14 months in court. A clear will minimizes conflicts and legal costs.

- Protecting Blended Families: Stepchildren, adopted relatives, and unmarried partners are excluded under Sharia. A will ensures intended beneficiaries receive their share.

5. Streamlining Probate and Reducing Costs

- Faster Probate Processing: Sharia probate takes 6–18 months, while DIFC-registered wills complete in 4–6 weeks. The DIFC’s online portal introduced in 2024 speeds up documentation submission.

- Lower Legal Expenses: Intestate cases incur high legal and translation fees. DIFC probate costs average AED 15,000, compared to AED 45,000+ for Sharia-based proceedings.

The benefits of registering a will

A registered will carries substantial legal weight in the UAE, ensuring that your asset distribution aligns with your explicit wishes. Here’s how you benefit:

– Legal clarity: A registered will minimizes ambiguity by documenting your intentions, helping courts resolve any uncertainties during probate.

– Efficient probate process: With a formal record in place, beneficiaries can avoid prolonged legal battles and expedite asset distribution.

– Reduction in family disputes: Clear legal instructions decrease the likelihood of disagreements among heirs, ensuring a smoother transition during difficult times.

Legal experts at DIFC Wills Service Centre emphasize that ensuring legal clarity through registration can protect not only your assets but also provide peace of mind for everyone involved.

Real-world implications and insights

Imagine leaving behind a clear, legally registered will. Your loved ones would have a definitive guide to the distribution of your assets, significantly reducing potential disputes and easing the administrative process during a challenging time.

Conversely, an unregistered or unclear will can lead to prolonged legal battles, adding stress to grieving families. A study by HSBC found that 61% of UAE residents have not planned for their financial legacy, highlighting the potential for widespread issues without proper will registration.

Whether it is a sharia compliant will or non-Muslim-wills, Juriszone has you covered

Frequently asked questions

Is will registration mandatory in the UAE?

While not mandatory, the UAE strongly encourages will registration to ensure that the testator’s wishes are respected and legal disputes are minimized. Registering your will strengthens its enforceability in court.

What are the benefits of using a will?

Using a will ensures that your estate is distributed according to your wishes, provides legal validation, and offers peace of mind to your beneficiaries by reducing potential conflicts.

What is the benefit of having a registered will?

A registered will stands up to legal scrutiny, ensures that your intentions are clearly documented, and simplifies the probate process. This offers legal clarity that benefits your family during a stressful time. Check out some templates for wills in Abu Dhabi here.

Secure your legacy today

Don’t leave your family’s future to chance. Review your estate planning today and consider the advantages of registering your will to protect your assets and ensure a worry-free future for your loved ones. For more practical guidance and information, explore our detailed page on will registration in Dubai

Click to know about cost of making will in Dubai

Take action now to secure your legacy and provide clarity for those you care about most.

Why Registering a Will in UAE is Important

Why Registering a Will in UAE is Important