What is Estate in UAE ?

Estate in UAE: Definition

An Estate in UAE (التركة in Arabic) in UAE law refers to the collective assets, rights, liabilities, and property that a person owns at the time of their death. The concept encompasses both tangible and intangible assets subject to Islamic Law (Sharia) and UAE Civil Law provisions.

Types of Estate

Real Estate Assets

- Property Types:

- Residential properties

- Commercial buildings

- Land holdings

- Investment properties

- Associated Rights:

- Ownership deeds

- Lease agreements

- Development rights

- Usufruct rights

Movable Assets

- Financial Holdings:

- Bank accounts

- Investment portfolios

- Insurance policies

- Business shares

- Personal Property:

- Vehicles

- Jewelry

- Household items

- Personal belongings

Estate Management

Legal Framework

- Islamic Law Provisions:

- Sharia inheritance rules

- Distribution quotas

- Heir categories

- Bequest limitations

- Civil Law Requirements:

- Registration procedures

- Asset documentation

- Court processes

- Administrative formalities

Estate Administration

Executor Responsibilities

- Initial Duties:

- Asset inventory

- Debt assessment

- Court notifications

- Heir identification

- Management Tasks:

- Estate preservation

- Asset valuation

- Debt settlement

- Distribution planning

Legal Procedures

- Court Requirements:

- Death certificate registration

- Inheritance certificate

- Asset documentation

- Heir verification

- Administrative Steps:

- Property registration

- Bank account management

- Business continuity

- Tax compliance

Rights and Obligations

Heir Rights

- Legal Entitlements:

- Inheritance shares

- Property rights

- Business interests

- Investment returns

- Procedural Rights:

- Information access

- Distribution participation

- Legal representation

- Appeal procedures

Estate Obligations

- Financial Duties:

- Debt settlement

- Tax payments

- Administrative costs

- Maintenance expenses

- Legal Requirements:

- Court fees

- Documentation charges

- Professional services

- Compliance costs

Estate Planning

Strategic Considerations

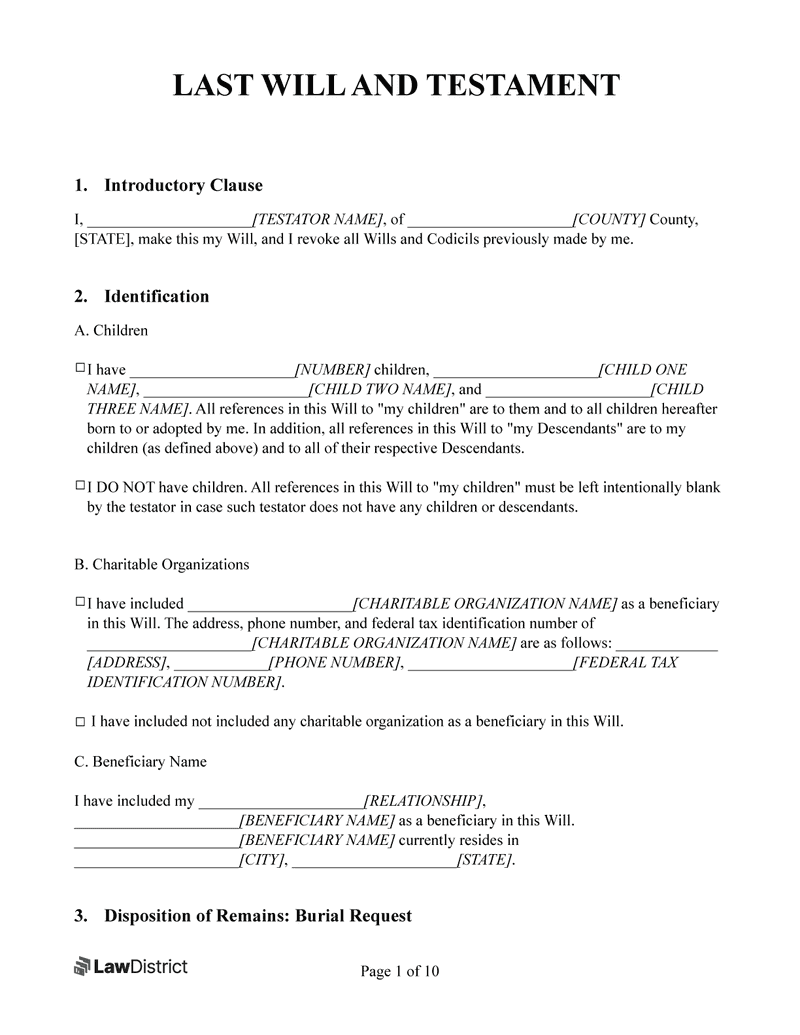

- Pre-death Planning:

- Will preparation

- Asset structuring

- Business succession

- Tax efficiency

- Documentation:

- Legal will

- Property titles

- Business ownership

- Investment records

Practical Aspects

Common Challenges

- Administrative Issues:

- Multiple jurisdictions

- Asset complexity

- Heir disputes

- Documentation gaps

- Resolution Methods:

- Legal mediation

- Court intervention

- Professional assistance

- Family agreements

Professional Support

- Required Services:

- Legal counsel

- Estate administrators

- Property valuers

- Financial advisors

- Expert Assistance:

- Documentation preparation

- Asset management

- Distribution planning

- Dispute resolution