What is Beneficiary in UAE ?

Beneficiary in UAE: Definition

A beneficiary in UAE (المستفيد in Arabic) plays a crucial role in UAE inheritance law. This comprehensive guide explains who can be a beneficiary, their rights, and how inheritance works in the UAE’s unique legal landscape.

Understanding Beneficiaries in UAE Context

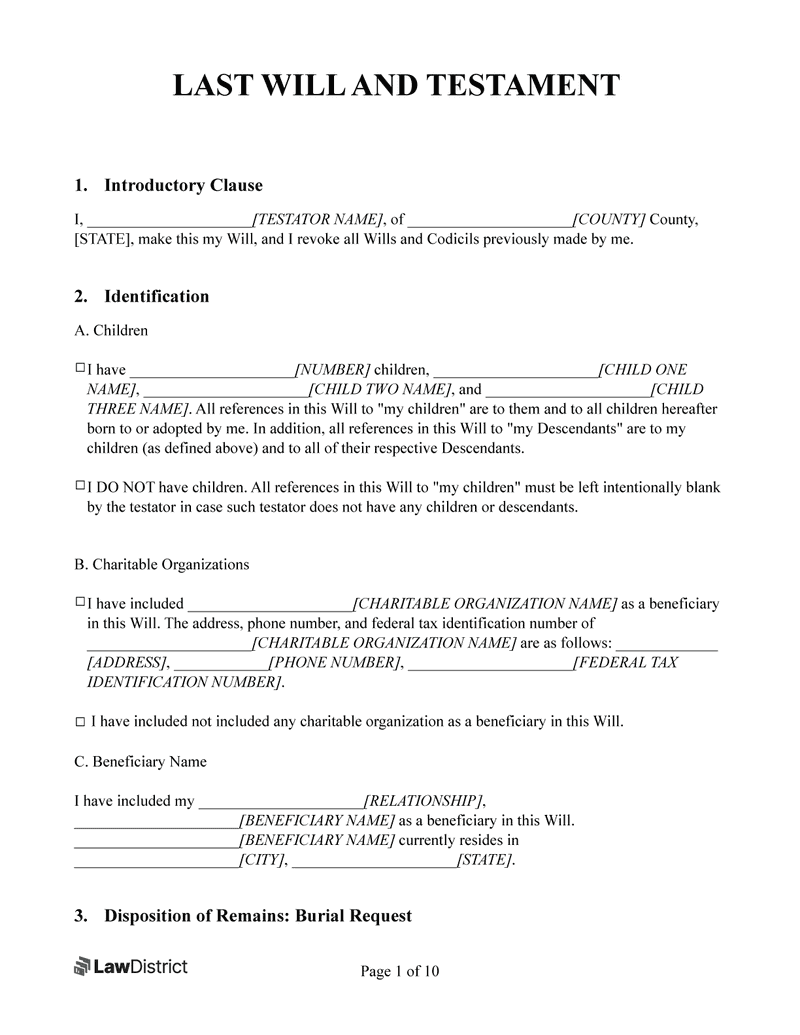

A beneficiary is an individual or entity legally entitled to receive assets, property, or benefits from a will, trust, or insurance policy in the UAE. This designation carries significant legal weight and varies depending on whether the inheritance falls under Sharia law or non-Muslim inheritance rules.

Types of Beneficiaries

The UAE legal system recognizes several categories of beneficiaries:

Primary Beneficiaries: These are the first-in-line recipients directly named in a will or trust. They have immediate rights to the inherited assets once the will is executed.

Contingent Beneficiaries: These individuals or entities inherit only if the primary beneficiaries are unavailable or unable to inherit. They serve as a backup to ensure proper asset distribution.

Residuary Beneficiaries: These recipients are entitled to any remaining assets after specific bequests have been distributed, often receiving the bulk of unclaimed or unspecified assets.

Legal Framework and Requirements

The UAE maintains distinct inheritance systems based on religious affiliation:

For Muslim Beneficiaries: Sharia law governs inheritance distribution with predetermined portions for family members. The UAE Personal Status Law mandates fixed shares for specific relatives, with limited flexibility for additional beneficiaries.

For Non-Muslim Beneficiaries: The DIFC Wills system offers greater flexibility in asset distribution. Under Dubai Law No. 15 of 2017, non-Muslims can designate beneficiaries according to their preferences, without Sharia law restrictions.

Claiming Inheritance

The process of claiming inheritance in the UAE involves several steps:

Documentation Requirements:

- Valid identification

- Proof of relationship

- Death certificate of testator

- Legal heir certificate (if applicable)

Verification Process:

- Court validation

- Legal authentication

- Distribution approval

Common Scenarios and Solutions

Expatriate Beneficiaries: Consider Sarah, a Canadian resident in Dubai, named as a beneficiary in her father’s DIFC will. Her inheritance process follows international standards, allowing straightforward access to UAE-based assets.

Local Beneficiaries: Fatima is an expat inheriting under Sharia law. Her share is predetermined based on her relationship to the deceased, ensuring fair distribution among family members.

Protection Measures

The UAE legal system provides various safeguards for beneficiaries:

Documentation Security:

- Proper identification verification

- Relationship authentication

- Claim validation procedures

Dispute Resolution:

- Court-supervised distribution

- Mediation services

- Legal representation options

Important Considerations

When dealing with beneficiary status in the UAE:

Timeline Expectations:

- Asset freezing period

- Documentation processing

- Distribution scheduling

Cultural Sensitivity:

- Religious considerations

- Family traditions

- Local customs

Practical Advice

For potential beneficiaries in the UAE:

- Keep all relevant documents updated

- Understand your legal rights

- Seek professional legal advice

- Maintain clear communication with executors

- Follow proper procedures for claims

The Role of Professional Support

Given the complexity of UAE inheritance law, beneficiaries often benefit from:

- Legal consultation

- Document preparation assistance

- Translation services

- Court representation