Understanding FZE vs FZCO Difference: Shareholder, Control & Compliance in UAE Free Zones

If you're launching a business in UAE, your first real decision isn’t where to set up. It’s choosing the legal structure that fits your goals. That means deciding between a Free Zone Establishment (FZE) and a Free Zone Company (FZCO).

In UAE Free Zones, an FZE allows only one shareholder, offers faster setup timelines (typically 5 to 7 working days), and requires no board formation. Minimum capital starts at AED 50,000, depending on the Free Zone authority. By comparison, an FZCO accommodates 2 to 50 shareholders, involves a longer registration process (7 to 10 working days), and mandates a formal board structure. Capital requirements are also higher, often beginning at AED 150,000. These differences influence not just governance and setup speed but also impact audit obligations, licensing flexibility, and eligibility for dual mainland expansion under updated UAE compliance rules.

FZE is ideal for solo founders seeking speed and simplicity with a lower capital requirement (AED 50K) and no board setup.

FZCO suits multi-shareholder ventures, requires more capital (AED 150K+), formal governance, and is often preferred for businesses planning external investment or dual mainland licensing.

This guide reflects post-2021 UAE laws, helping you avoid outdated advice and choose the right Free Zone structure.

Table of Content

- Overview

- What Is a Free Zone Establishment (FZE) in the UAE?

- What Is a Free Zone Company (FZCO) in the UAE?

- When Should Entrepreneurs Choose an FZE or FZCO?

- How Does the UAE Freezone Company Setup Process Work for FZE and FZCO?

- What Registers Are Required for FZE and FZCO Structures in the UAE?

- Governance and Ownership for Free Zone Establishment (FZE) in the UAE

- Governance and Ownership for Free Zone Company (FZCO) in the UAE

- What Are the Costs and Taxes for FZE and FZCO Companies in UAE Free Zones?

- What Specific Rules Apply to Freezone Business Structures in the UAE?

Overview

| Attribute | FZE | FZCO |

| Legal Structure | Single shareholder company structure | Multi-shareholder company structure |

| Min. Shareholders | 1 | 2+ |

| Foreign Ownership | 100% allowed | 100% allowed |

| Capital Requirement | AED 50,000 to AED 1,000,000 | AED 150,000 to AED 2,000,000 |

| Governance | No board required, sole decision-maker | Board and formal shareholder governance required |

| Share Transferability | Rare; requires Freezone approval | Allowed; requires Freezone approval |

| Trading Scope | Freezone + international (DED dual license for mainland) | Freezone + international (DED dual license for mainland) |

| Setup Time | 5–7 working days | 7–10 working days |

| Visa Eligibility | Visa quotas available for owner and employees | Visa quotas available for shareholders and employees |

| VAT Obligations | VAT registration if turnover > AED 375,000 | VAT registration if turnover > AED 375,000 |

| Corporate Tax | 0% Freezone income, 9% on mainland-sourced income | 0% Freezone income, 9% on mainland-sourced income |

| Ideal For | Solo entrepreneurs, freelancers, and consultants | Startups, partnerships, investor-ready companies |

What Is a Free Zone Establishment (FZE) in the UAE?

A Free Zone Establishment (FZE) is a legal company structure available in UAE Free Zones designed for entrepreneurs, individual investors, and businesses that require full foreign ownership and single-shareholder control.

A Freezone FZE is a subtype of Freezone Company created specifically for single ownership, distinct from a Free Zone Company (FZCO), which allows multiple shareholders.

The FZE structure became formalized in Jebel Ali Free Zone (JAFZA) in 2000, following earlier Freezone laws from 1985. Entrepreneurs choosing an FZE benefit from simplified governance because no board of directors is required and the sole shareholder retains full control of management decisions and profits.

Capital requirements vary: Freezones like Sharjah Media City (Shams) offer lower thresholds while others such as Dubai Multi Commodities Centre (DMCC) set higher requirements, often depending on business activity.

FZEs can trade internationally and within their Freezone jurisdiction. However, to conduct business directly with the UAE mainland, an FZE must apply for a dual license from the Department of Economic Development (DED).

What Is a Free Zone Company (FZCO) in the UAE?

A Free Zone Company (FZCO) is a legal structure within UAE Freezones that allows two or more shareholders to establish a business with 100% foreign ownership.

An FZCO is similar to an FZE but permits multiple shareholders and functions as a flexible limited liability structure regulated by individual Freezone authorities.

The FZCO structure emerged in the late 1990s as Freezones expanded to accommodate joint ventures and startups seeking external investment and formal equity arrangements.

Entrepreneurs and companies choosing an FZCO must adopt formal governance frameworks, including appointing managers or directors and holding annual shareholder meetings. Ownership is divided into shares, making FZCOs attractive for startups, partnerships, and businesses preparing for future investors.

Capital requirements differ by jurisdiction and activity: for example, an FZCO in Dubai Multi Commodities Centre (DMCC) may require AED 300,000 minimum capital for general trading, while Fujairah Free Zone often sets lower thresholds to attract smaller businesses.

Like FZEs, FZCOs can operate internationally and within their Freezone but must obtain a dual license from the Department of Economic Development (DED) to trade on the UAE mainland.

When Should Entrepreneurs Choose an FZE or FZCO?

A Free Zone Establishment (FZE) is best suited for solo entrepreneurs, consultants, freelancers, or small businesses where one individual or corporate entity seeks full control, fast setup, and simple governance.

An FZE is ideal for businesses focusing on international trade or services provided within the Freezone itself.

For example, a consultant from the United Kingdom serving Gulf Cooperation Council (GCC) clients may set up an FZE in Dubai Multi Commodities Centre (DMCC) to take advantage of 100% foreign ownership and streamlined licensing.

In contrast, a Free Zone Company (FZCO) is ideal for startups, partnerships, or investor-backed ventures that require multiple shareholders and structured governance.

An FZCO enables clear shareholding arrangements, board-level oversight, and investor readiness from day one.

For instance, a renewable energy startup with three co-founders might establish an FZCO in Abu Dhabi Global Market (ADGM) to facilitate future capital raising and meet governance requirements.

FZCO serves as a multi-shareholder equivalent of an FZE, providing the same foreign ownership and tax advantages but with added flexibility for equity participation.

If you’re also evaluating which type of Free Zone entity is right for you, this guide on the difference between FZ LLC and FZE breaks down ownership, liability, and structure in clear detail.

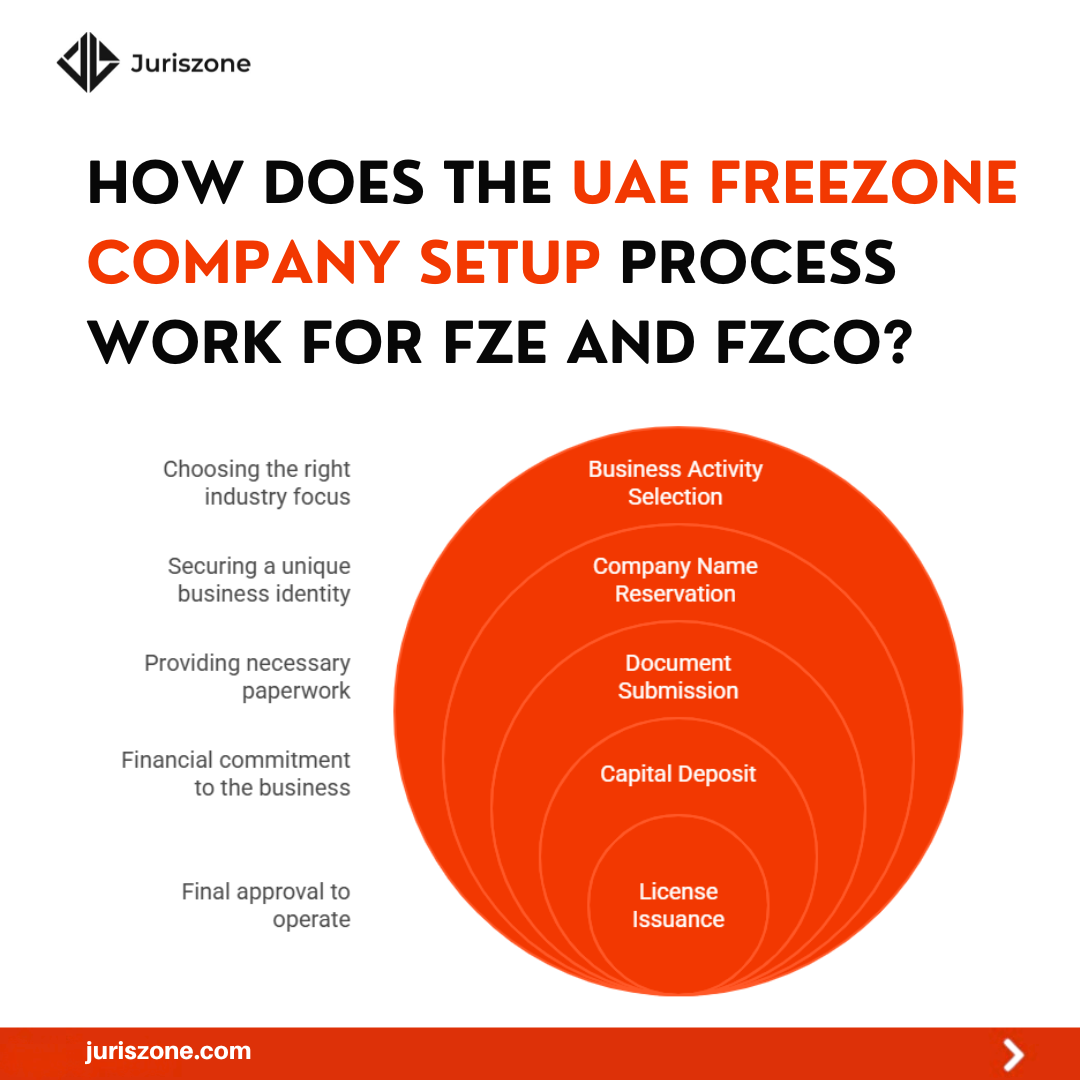

How Does the UAE Freezone Company Setup Process Work for FZE and FZCO?

Entrepreneurs establishing a Free Zone Establishment (FZE) or Free Zone Company (FZCO) must begin by selecting their business activity and applying to the relevant Freezone authority.

This process involves reserving a company name, submitting documents like passport copies, lease agreements, and Ultimate Beneficial Owner (UBO) declarations under Cabinet Decision No. 58 of 2020, and paying registration fees.

An FZE is faster and simpler because it involves only one shareholder and minimal governance requirements.

Capital must be deposited in a UAE escrow account before the license is issued.

Licensing typically takes five to seven working days in zones such as Sharjah Media City (Shams) and Dubai Multi Commodities Centre (DMCC).

An FZCO requires additional documentation, including shareholder agreements and board appointments.

All shareholders must complete UBO disclosures and deposit capital, often between AED 150,000 and AED 2,000,000, depending on the Freezone and activity.

Licensing typically takes seven to ten working days.

An FZCO setup follows the same core process as an FZE but adds complexity due to its multi-shareholder structure and formal governance obligations.

After incorporation, both FZE and FZCO businesses must secure office space, obtain an establishment card, and process visas if required.

Some Freezones, like Abu Dhabi Global Market (ADGM), may conduct a site inspection before issuing the final license.

Get Free Consultation: Discuss Pricing Today!

What Registers Are Required for FZE and FZCO Structures in the UAE?

Both Free Zone Establishments (FZE) and Free Zone Companies (FZCO) must maintain core registers to comply with UAE corporate governance standards.

These include a Shareholder Register, a Manager or Director Register, and mandatory Ultimate Beneficial Owner (UBO) disclosures under Cabinet Decision No. 58 of 2020.

An FZE requires simpler recordkeeping due to its single shareholder structure.

By contrast, an FZCO must document multi-shareholder arrangements, including shareholder resolutions and appointments or removals of directors.

Relationship statement: Both FZE and FZCO are governed by Freezone regulations that now align with OECD transparency standards and FATF guidelines, ensuring they meet international compliance expectations.

Governance and Ownership for Free Zone Establishment (FZE) in the UAE

An FZE is governed directly by its sole shareholder, who holds full control over management, decisions, and profits.

This structure requires no board of directors or formal meetings, making governance simple and fast.

Ownership is limited to one individual or company holding 100% equity and voting rights.

Any ownership transfer is rare but requires Freezone authority approval and documentation.

An FZE is a streamlined variant of Freezone Company structures designed for single ownership with minimal governance requirements.

Governance and Ownership for Free Zone Company (FZCO) in the UAE

An FZCO requires two or more shareholders and a formal governance structure.

It must appoint at least one manager or board of directors, and annual shareholder meetings are standard practice.

Ownership is divided into shares, with rights proportional to each shareholder’s holding.

Shares can be transferred but transfers require approval from the Freezone authority.

Relationship statement: An FZCO is similar to an FZE but designed for shared ownership, providing a flexible limited liability structure within Freezones.

This makes FZCO ideal for partnerships, startups, and investor-backed ventures where structured governance is needed.

What Are the Costs and Taxes for FZE and FZCO Companies in UAE Free Zones?

Entrepreneurs setting up an FZE or FZCO in UAE Freezones face different financial requirements than mainland companies.

An FZE generally requires a minimum capital deposit between AED 50,000 and AED 1,000,000 depending on the Freezone and business activity. For instance, Sharjah Media City (Shams) offers lower capital requirements to attract freelancers and solo traders.

An FZCO demands higher minimum capital, typically AED 150,000 to AED 2,000,000, reflecting its multi-shareholder structure. In Dubai Multi Commodities Centre (DMCC), general trading FZCOs often require AED 300,000 in capital.

Both FZE and FZCO structures benefit from a 0% corporate tax rate on qualifying Freezone income provided they meet substance and activity rules. However, any UAE mainland income above AED 375,000 is taxed at 9% from June 2023.

VAT registration applies once turnover exceeds AED 375,000 annually, ensuring Freezone entities remain compliant with UAE tax obligations.

What Specific Rules Apply to Freezone Business Structures in the UAE?

Freezone companies operate under distinct regulatory frameworks compared to UAE mainland businesses. Many Freezones allow companies to apply for a dual license from the Department of Economic Development (DED) so they can serve mainland clients while remaining registered within a Freezone.

Several Freezones are sector-specific. For example, Dubai Multi Commodities Centre (DMCC) focuses on trading businesses, twofour54 targets media companies, and Abu Dhabi Global Market (ADGM) provides a legal environment aligned with international financial standards.

Since 2021, all Freezone businesses, including FZE and FZCO structures, must comply with Federal Decree-Law No. 45 of 2021 on Personal Data Protection. This law governs the collection, processing, and storage of personal data across Freezone entities.

Can FZE or FZCO Use a Dual License to Serve Mainland UAE Markets?

A dual license allows a Freezone Establishment (FZE) or Free Zone Company (FZCO) to trade legally in the UAE mainland while remaining based in a Freezone. Many Freezones, such as DMCC, ADGM, and RAKEZ, now support this option for businesses that meet specific regulatory conditions.

A dual license lets an FZE or FZCO operate in both Freezone and mainland markets, offering broader customer reach while balancing cost and regulatory trade-offs. Businesses apply to the Department of Economic Development (DED), meet leasing requirements, and must comply with additional approvals and taxation considerations.

This structure appeals to entrepreneurs and companies that want Freezone tax advantages but need direct access to mainland clients, contracts, and tenders.

Check out the difference between Free Zone establishment and Freezone LLC

Frequently Asked Questions

Can a Freezone company convert to a mainland LLC?

Yes. A Freezone company can restructure as a mainland LLC, but this requires cancelling the Freezone license and registering anew with the Department of Economic Development (DED). The process involves new approvals and documentation.

Is 100% foreign ownership allowed for all Freezone structures?

Yes. Freezones like DMCC, RAKEZ, and ADGM allow full foreign ownership for both FZE and FZCO structures, following the UAE’s 2021 company law reforms.

How long does it take to set up each structure?

An FZE usually takes 5–7 working days. FZCO setup takes 7–10 working days due to multi-shareholder documentation.

Are Freezone companies required to have audited financial statements?

FZCOs must file audited financials annually regardless of revenue. FZEs may be exempt if below a revenue threshold, depending on Freezone policy.

Can an FZE or FZCO charge VAT to a UAE mainland LLC?

Yes. If an FZE or FZCO provides taxable goods or services to a mainland LLC, they must register for VAT (if above AED 375,000 annual turnover) and charge 5% VAT, or the LLC may self-account using the reverse-charge mechanism.

Can a Freezone visa be transferred to an LLC?

No. Freezone visas cannot transfer directly. The visa must be cancelled and a new visa issued under the mainland LLC, following UAE labor and immigration laws.