Understanding the difference between FZ-LLC vs FZE Freezone structure in Dubai.

FZ‑LLC and FZE are UAE Free Zone business structures that offer 100% foreign ownership, limited liability, and fast setup. The main difference is shareholder count: FZE is for solo founders, while FZ‑LLC is for two or more shareholders. Choose FZ‑LLC for growth and governance; choose FZE for simplicity and speed.

Understanding the difference between an FZ-LLC and an FZE is required when forming a company in a UAE free zone. Both offer 100% foreign ownership and limited liability. The key distinction lies in shareholder structure. This guide compares FZ‑LLC and FZE to help you choose the right setup in zones like Meydan, DMCC, RAKEZ, and Shams.

-

FZE is for solo founders; FZ‑LLC allows multiple shareholders.

-

FZE offers faster setup with simpler governance.

-

FZ‑LLC is better for raising capital and scaling with partners or investors.

-

Both structures offer 100% foreign ownership and visa eligibility.

-

UAE banks and free zone authorities often favor FZ‑LLC for structured operations

Table of Content

- What Do FZ‑LLC and FZE Mean?

- How Many Shareholders Are Allowed in an FZ‑LLC and FZE?

- What Are the Naming and License Requirements for FZ‑LLC and FZE?

- What Are the Capital Requirements Differences Between FZ‑LLC and FZE?

- How Do Governance and Shareholder Structures Differ Between FZ‑LLC and FZE?

- Can You Change from FZE to FZ‑LLC?

- FAQs

What Do FZ‑LLC and FZE Mean?

An FZE is built for a single shareholder. It offers a fast, low-friction setup with minimal paperwork, often favored by freelancers, solopreneurs, or consultants.

An FZ LLC allows two or more shareholders. These can be individuals, corporate entities, or a combination of both. It is designed for joint ventures, investor-backed startups, or multi-founder businesses that require a formal board or management structure.

In simple terms:

- FZE = One owner, simple setup.

- FZ‑LLC = Multiple owners, scalable governance.

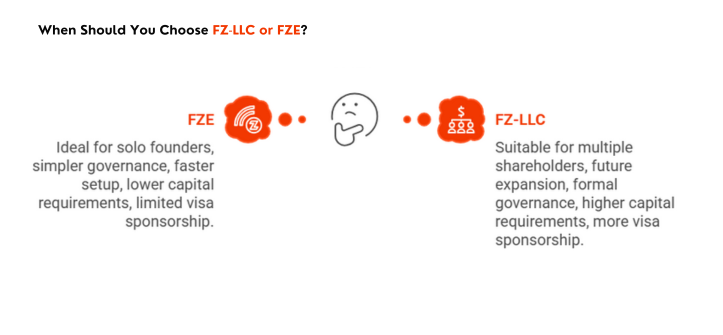

When Should You Choose FZ LLC or FZE?

Your ideal structure depends on how you plan to grow, who is involved, and what compliance responsibilities you are ready to handle.

Choose an FZE if:

- You are the sole founder and want full control

- You need to launch quickly with minimal documents

- You prefer lower setup costs and simplified capital requirements

- You are not planning to raise funds or issue equity soon

Choose an FZ LLC if:

- You have co founders or investors

- You expect to issue equity or onboard shareholders in the future

- You are prepared to appoint a manager or form a board

- You need stronger banking credibility or plan to scale in UAE

Banking tip: UAE banks often prefer FZ LLCs because of their defined governance structure. While FZEs can open accounts, approval may take longer due to sole ownership.

Visa insight: Both structures qualify for UAE residence visas. FZ LLCs may access higher visa quotas depending on office size and activity license.

Governance reminder: An FZ LLC requires formal resolutions and annual meetings. FZEs skip these steps, giving solo founders streamlined control.

Comparison Table: When Should You Choose FZ LLC or FZE?

| Decision Factor | Choose FZE | Choose FZ LLC |

| Number of Shareholders | 1 (solo founder) | 2 or more (co-founders or investors) |

| Future Expansion Plans | No immediate need for equity or new stakeholders | Planning to raise capital or onboard shareholders |

| Governance Simplicity | Full control by one owner, no board required | Requires board or manager, formal decision-making |

| Setup Speed | Faster setup, minimal documentation | Slightly slower, requires shareholder agreements |

| Capital Requirements | Lower (e.g., AED 10,000 in RAKEZ) | Higher (e.g., AED 50,000 in DMCC) |

| Visa Sponsorship Needs | Eligible, with some quota limits by office size | Eligible, often supports more visas with larger offices |

| Bank Account Opening Ease | Possible, but may involve more scrutiny | Preferred by banks for structured governance |

| Conversion Flexibility | Can be converted to FZ LLC later if needed | Already built for multi-stakeholder operations |

| Best For | Freelancers, solo entrepreneurs, consultants | Startups, partnerships, investor backed companies |

How Many Shareholders Are Allowed in an FZ‑LLC and FZE?

An FZ‑LLC requires two or more shareholders, who can be individuals, corporate entities, or a combination of both. Some UAE Free Zones, such as Dubai Multi Commodities Centre (DMCC), allow up to 50 shareholders in an FZ‑LLC, offering flexibility for partnerships or startups seeking outside investment.

Official Shareholder Combinations

, FZ LLC may include:

- Natural persons (individuals)

- Corporate persons (legal entities)

- A mix of both

An FZE is restricted to a single shareholder. This structure is purpose-built for solo founders and cannot accommodate multiple shareholders unless formally converted to an FZ‑LLC.

An FZ‑LLC allows multi-party ownership, while an FZE is built for sole ownership, directly influencing governance complexity and ownership flexibility.

What Are the Naming and License Requirements for FZ‑LLC and FZE?

Both FZ‑LLC and FZE companies must reflect their legal structure in their registered name. This requirement ensures transparency for regulators, business partners, and clients.

For an FZE, the name suffix must include “FZE” (for example, “ABC Consulting FZE”) indicating a single-shareholder free zone establishment. For an FZ‑LLC, the name suffix must include “FZ‑LLC” (for example, “XYZ Trading FZ‑LLC”), signaling a multi-shareholder free zone company.

The suffix helps distinguish whether a free zone entity is a single-owner (FZE) or a company with multiple shareholders (FZ‑LLC).

Both structures require obtaining a license from the relevant free zone authority, such as DMCC, RAKEZ, or Sharjah Media City (Shams). The license type depends on the business activity (e.g., consulting, trading, industrial). These licenses are distinct from UAE mainland DED licenses and are valid for operations within the free zone and internationally, unless a dual license is obtained for mainland trading.

What Are the Capital Requirements Differences Between FZ‑LLC and FZE?

Capital requirements for FZ‑LLC and FZE companies depend on the rules of each free zone, but key patterns help entrepreneurs understand the financial expectations when forming a UAE free zone entity.

An FZE typically requires a lower minimum capital because it is designed for single ownership. For example, Ras Al Khaimah Economic Zone (RAKEZ) may set a minimum capital as low as AED 10,000 for service businesses.

By contrast, an FZ‑LLC generally requires a higher threshold, reflecting its multi-shareholder structure. For instance, Dubai Multi Commodities Centre (DMCC) requires AED 50,000 for a general trading FZ‑LLC license.

An FZE is a single-shareholder variant with simplified capital requirements, whereas an FZ‑LLC is designed for partnerships and requires capital commensurate with its governance structure.

Some free zones set identical capital requirements for both structures, while others differentiate by shareholder count or activity type. Entrepreneurs and businesses must confirm minimum thresholds directly with their target free zone, as this affects both budgeting and approval timelines.

How Do Governance and Shareholder Structures Differ Between FZ‑LLC and FZE?

Both FZE and FZ LLC structures must comply with UAE Free Zone regulations. This includes registering shareholders, directors, and Ultimate Beneficial Owners (UBOs) in line with Cabinet Decision Number 58 of 2020. These rules ensure transparency and proper oversight.

This governance distinction helps business owners align their setup with future goals. Solo founders gain flexibility with an FZE, while growing companies benefit from the scalability and investor readiness of an FZ LLC.

Get Free Consultation: Discuss Pricing Today!

Can You Change from FZE to FZ‑LLC?

Entrepreneurs who initially register a Free Zone Establishment (FZE) often want to know if they can convert their business into a Free Zone Limited Liability Company (FZ‑LLC) later. The answer is yes: most UAE Free Zones allow an FZE to restructure as an FZ‑LLC if new shareholders are added.

For example, Dubai Multi Commodities Centre (DMCC) offers a formal process for FZE-to-FZ‑LLC conversion, requiring updates to shareholder agreements, board appointments, UBO declarations, and approval by the Free Zone authority. Similarly, Abu Dhabi Global Market (ADGM) allows restructuring to accommodate multi-shareholder governance while retaining Free Zone benefits.

An FZ‑LLC is essentially an FZE adapted to allow multiple shareholders, making conversion a flexible option for scaling companies.

This flexibility ensures that entrepreneurs can start as a sole-owner FZE and evolve into an FZ‑LLC as partnerships or investors are added.

Also checkout FZE vs FZCO for a complete guide

FAQs

1. Which Free Zones support FZE and FZ-LLC?

Popular zones include:

- RAKEZ

- DMCC

- Fujairah Creative City

- Dubai South

- SHAMS

Each has different shareholder and license rules.

2. Can foreigners own 100% of FZ companies in Dubai?

Yes. Both FZ-LLC and FZE structures offer 100% foreign ownership, depending on the Free Zone and business activity.

3. What are the tax implications of FZ-LLC vs FZE?

Generally identical—both benefit from UAE’s 0% corporate tax for most Free Zone businesses (if not mainland-facing). However, VAT and Corporate Tax (9%) may apply in some cases. Always confirm with a tax advisor.

4. Can FZE companies open corporate bank accounts in UAE?

Yes, but FZ-LLCs typically find it easier due to their structure and multiple shareholders. Bank due diligence may vary by Free Zone. Juriszone provides complete support in assistance related to banking.

5. Do FZE and FZ-LLC differ in Free Zone authority approvals?

Slightly. FZ-LLCs often require more documentation, particularly when a corporate shareholder is involved (MOA, shareholder). FZEs may clear faster for simpler business models.

6. Can FZ-LLC and FZE both apply for investor visas?

Yes. Both can sponsor residency visas, though quota and limits depend on the Free Zone and office type (flexi-desk vs physical).

- What is the main difference between a Free Zone LLC and a Mainland LLC?

A Free Zone LLC (FZ-LLC) operates under a specific Free Zone authority and is limited to doing business within the Free Zone and internationally. A Mainland LLC, licensed by the Department of Economic Development (DED), can conduct business anywhere in the UAE.

Check out the guide on Freezone LLC vs Mainland LLC

- Is an FZE easier to set up than an FZ‑LLC?

Yes. FZEs generally require fewer documents and approvals, resulting in a faster setup process. This makes them more accessible for first-time entrepreneurs.

- What documents are required to open an FZ-LLC in the UAE Freezone?

Register an FZ-LLC by submitting a completed application, shareholder details, notarised corporate documents if submitted from outside the UAE, and passport copies.