DIFC Property Wills

A DIFC Property Wills provide a secure and legally recognized option for non-Muslim property owners in the UAE to manage their assets. It ensures distribution according to personal wishes while offering a practical alternative to Sharia-based inheritance laws.

What is a DIFC Property Will?

A DIFC Property Wills allows non-Muslim property owners in the UAE to establish asset distribution outside Sharia law, ensuring their real estate holdings are managed as per their wishes. The Dubai International Financial Centre (DIFC) Courts offer this will service to protect up to five properties through a Property Will, creating a secure legal pathway for expatriates in the UAE.

DIFC Jurisdiction

The DIFC Wills Service is specifically designed to address the needs of expatriates, making it a preferred option for non-Muslims seeking clear legal protection for their estate plans within the UAE.

DIFC Legal Framework and Enforceability

DIFC Property Wills are enforced through the DIFC Courts, which operate under a legal framework that ensures enforceability across all UAE jurisdictions. This will remain valid in countries outside the UAE if those countries recognize the will.

Why Register a DIFC Property Will?

Registering a DIFC Property Wills provides several benefits for non-Muslim expatriates who wish to maintain control over their estate:

- Avoidance of Sharia Law – DIFC Property Wills allow expatriates to designate beneficiaries and specify asset distribution, avoiding the default Sharia-based inheritance laws that apply in the UAE.

- Legal Certainty and Peace of Mind – By registering a DIFC Property Will, expatriates can be assured that their assets will be distributed according to their wishes, reducing the likelihood of disputes among heirs.

- Estate Protection and Flexibility – DIFC Wills cover a range of assets, including real estate, investments, and bank accounts, enabling expatriates to protect their most valuable assets within a secure legal framework.

Connect With Our Experts Will Draftsmen

Reach out to our experts for guidance on drafting your will fill out the form below to get in touch.

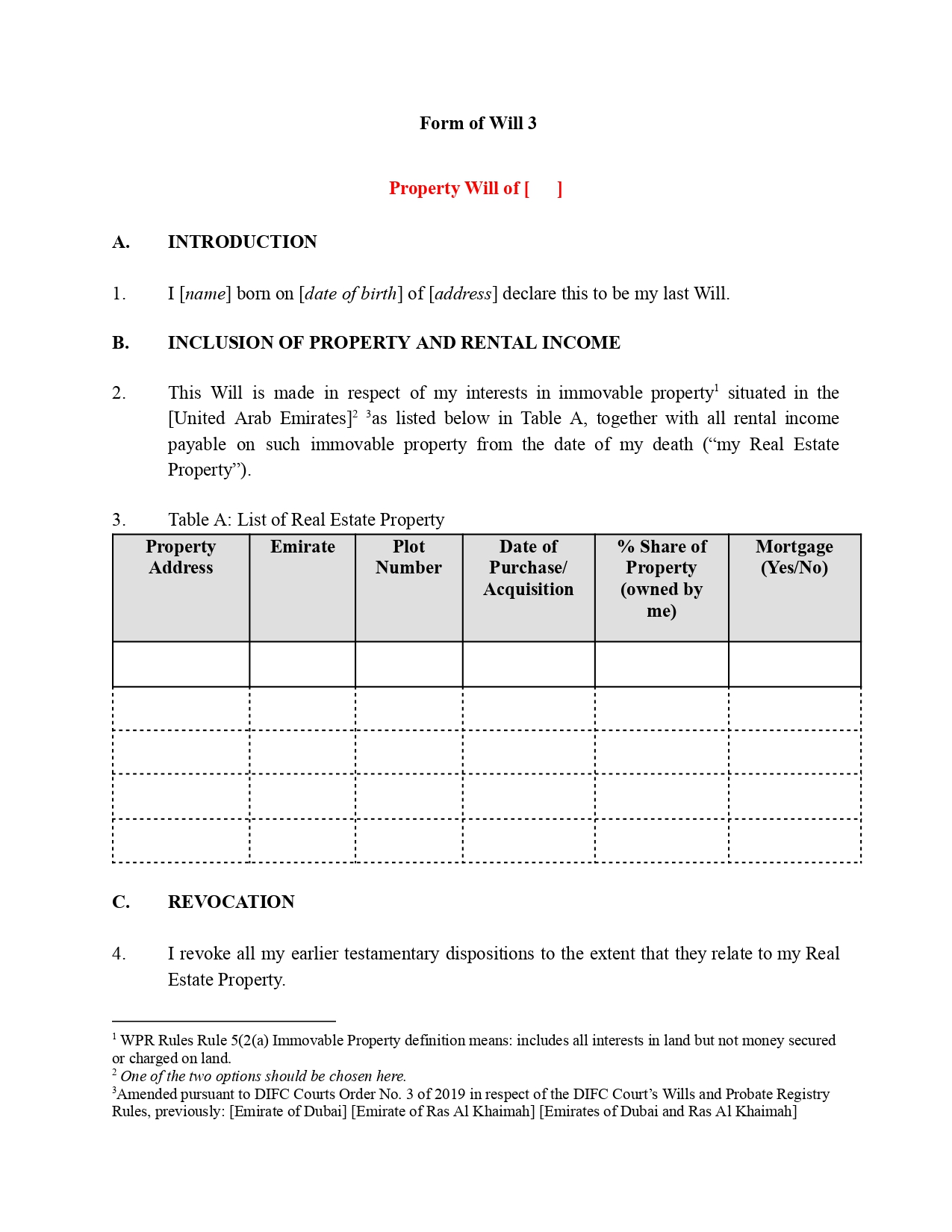

Key Features of a DIFC Property Will:

- Asset Coverage – You can include up to five real estate properties situated within the UAE, regardless of whether they are fully or partially owned.

- Ownership Proof – It’s essential to provide proof of ownership, such as title deeds, for the properties listed in the will.

- Registration Process – The DIFC Courts offer an online facility, known as the ‘Property Will Portal,’ allowing eligible individuals to complete and submit their Property Will for registration. Pre-registration checks can be conducted by appointment either in person or via the Virtual Registry.

- Legal Framework – The Property Will is governed by the DIFC Courts Wills and Probate Registry Rules, ensuring that the distribution of assets aligns with the testator’s intentions.

Eligibility Requirements

To register a DIFC Property Will, you must:

- Be a non-Muslim and have never been a Muslim.

- Be at least 21 years old.

- Own assets in the UAE and/or have minor children residing in the UAE.

How to Register a Property Will

- Step 1: Choose Between a Single or a Mirror Will – Select a Single Will if registering individually, or a Mirror Will if registering alongside a spouse, which offers a reduced registration fee.

- Cost – AED 3,500 for a Single Will, AED 5,500 for Mirror Wills.* [ Court fees are not included ]

- Step 2: Consider Legal Advice – Drafting a will is critical, and legal guidance ensures compliance with DIFC rules. The DIFC Wills Service provides a list of approved legal practitioners experienced in DIFC Will regulations.

- Step 3: Create Your Property Will – Use the Property Will Portal to access templates and guidance notes. The online platform simplifies the drafting process, enabling easy completion and submission for official registration.

DIFC Property Wills FAQ

Registration is completed through the DIFC Courts’ Property Will Portal. Applicants can go through pre-registration checks and complete their will either in-person or virtually, depending on their preference.

Consult Juriszone to get started

Secure your property’s future with Juriszone’s skilled DIFC draftsmen, ensuring every detail of your will is precise and compliant with regulations. Our experts specialize in simplifying the process, offering personalized guidance to align your estate plan with your exact wishes. Start today and gain the peace of mind that comes with knowing your legacy is in safe hands.

Have Additional Questions?

- 2101, 21st Floor, The Binary By Omniyat, Business Bay, Dubai, UAE

- +971 50 504 6703

- info@juriszone.com

DIFC Full Wills

If you want a will that includes both asset distribution and guardianship provisions, register a Full Will.

DIFC Financial Assets Wills

Non-Muslims can register a “Financial Assets Will” with the DIFC Courts for their bank and brokerage accounts.

DIFC Business Owners Wills

Non-Muslims can register a “Business Owners Will” with the DIFC Courts for who own shares in UAE-based companies.

DIFC Guardianship Wills

Non-Muslims with minor children can use the DIFC Courts to register a “Guardianship Will.”

DIFC Digital Assets Will

Non-Muslims can register a “Digital Assets Will” allows the testator to store their digital assets in a non-custodial wallet.