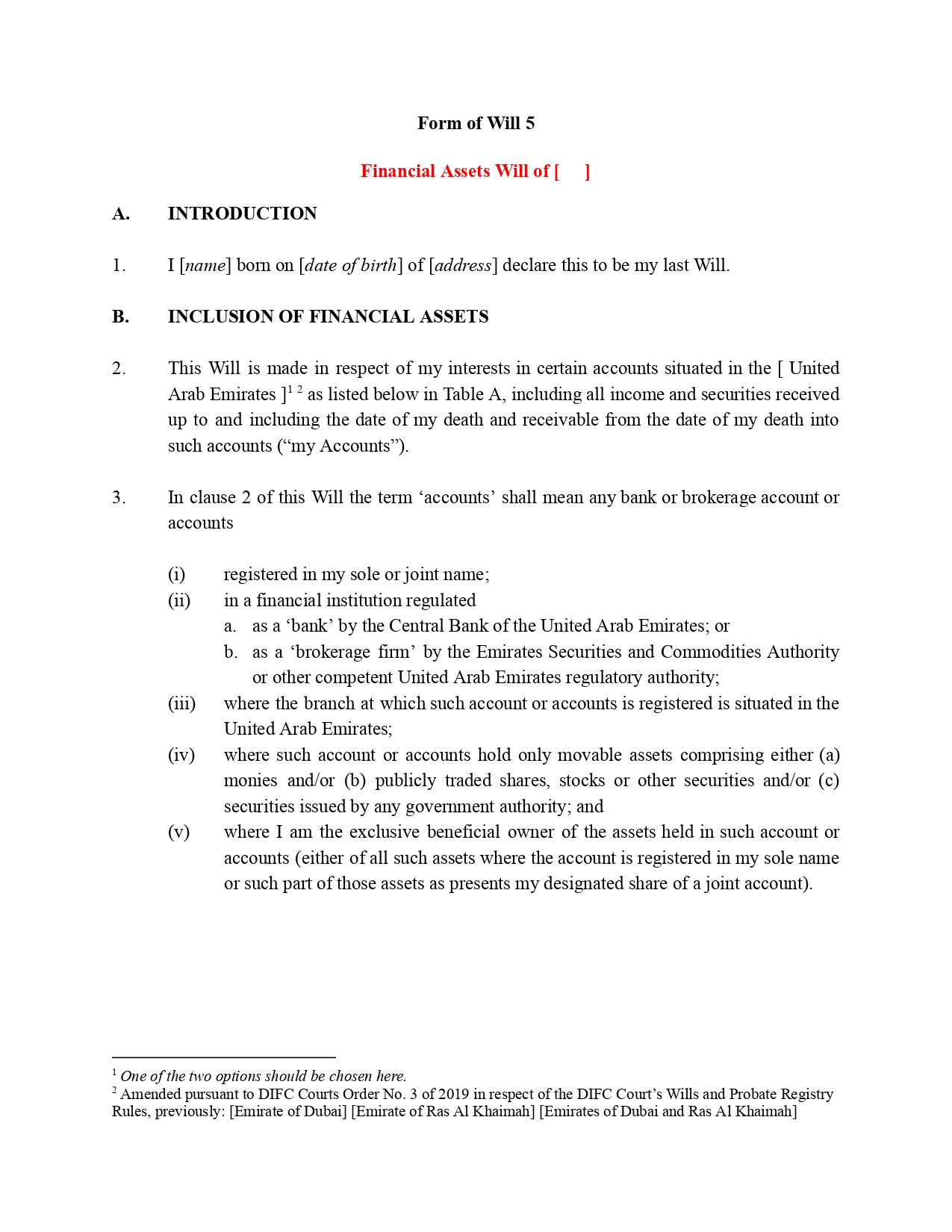

DIFC Financial Assets Will

The DIFC Financial Assets Will is a legal document designed for non-Muslim individuals who possess financial assets in the UAE. By choosing a DIFC Financial Assets Will, you can ensure that your assets are distributed in a way that aligns with your wishes and remains legally protected in the UAE.

DIFC Financial Assets Will: Key Details

- Scope – Exclusively covers financial assets such as bank accounts, investments, and securities held in the UAE and even worldwide.

- Eligibility – Available solely to non-Muslim individuals aged 21 or older.

- Legal Framework – Operates under DIFC’s common law jurisdiction and internationally recognized legal system, ensuring asset distribution aligns with the individual’s wishes, free from Sharia law applications.

- Process – The probate process focused on the efficient transfer of financial assets to designated beneficiaries.

- Single and Mirror Will Options – Single wills are AED 5,000, while Mirror Wills for husband and wife cost AED 7,500.

- Online Facility – The Financial Assets Will Portal facilitates online registration, with pre-registration checks available in person or via the Virtual Registry.

Connect With Our Experts Will Draftsmen

Reach out to our experts for guidance on drafting your will fill out the form below to get in touch.

Top 4 Benefits of a DIFC Financial Assets Will

- Clear Legal Protection for Your Financial Assets – A DIFC Financial Assets Will gives expatriates and foreign investors clear, reliable control over their money and investments within the UAE. This means that your financial assets will be passed on as you intend, without unexpected issues or challenges, using a legal framework respected worldwide.

- Designed Exclusively for Non-Muslim Financial Assets – This will type is specially created for non-Muslim individuals, allowing you to decide who inherits your financial assets without being subject to Sharia law. This gives you the full testamentary freedom to ensure your assets are managed and distributed according to your personal wishes.

- Faster and Smoother Process for Inheriting Financial Assets – DIFC Financial Assets Wills make the process of transferring financial assets quicker and simpler. By reducing delays and cutting down on paperwork, this type of will ensures that your beneficiaries receive the assets smoothly, without unnecessary waiting or complications.

- Reliable Protection for Your Financial Investments – The DIFC’s Wills and Probate Rules (WPR) help keep your financial assets safe and ensure everything is done properly. This layer of protection minimizes risks, making sure your investments keep their value and reach your beneficiaries just as you planned.

Steps to Create a DIFC Financial Assets Will

Setting up a DIFC Financial Assets Will is straightforward, and designed to offer both clarity and compliance:

- Review Your DIFC Assets – Compile a complete inventory of all your financial assets.

- Consult a DIFC-Registered Wills Draftsman – The Wills Draftsman ensures the will complies with DIFC regulations.

- Draft and Finalize the Will – Work with your expert wills draftsman to clearly define beneficiaries, asset allocations, and other important details.

- Register the Will with DIFC Courts – Once completed, the will is submitted to the DIFC Wills and Probate Registry for official registration.

- Regular Will Updates – Regular updates maintain the will’s relevance, adapting it to any changes in assets or personal circumstances.

Key Requirements for DIFC Financial Assets Will Registration

To legally register a will with DIFC, specific criteria must be met:

- The will must cover your financial assets in the UAE or worldwide

- Applicants must be non-Muslims and at least 21 years old.

- The will should include identified beneficiaries and asset allocations.

- The involvement of a registered will draftsman is necessary to ensure compliance.

Why Choose DIFC Will Services Over Other Inheritance Solutions?

Choosing a DIFC Financial Assets Will offers unique benefits for foreign investors compared to other estate planning options available within the UAE:

- Global Credibility – DIFC wills are backed by an internationally respected jurisdiction, making enforcement more predictable.

- Speedy Resolution – DIFC Courts prioritize quick inheritance resolution, which minimizes delays often experienced in local probate processes.

- Direct Control Over Financial Legacy – A DIFC Financial Assets will ensure your legacy is protected and managed within the secure DIFC jurisdiction, offering a focused asset control option.

DIFC Financial Assets Wills FAQ

Yes, a DIFC-registered Will Draftsman is essential to guide you through the drafting and registration process in compliance with DIFC rules.

Conclusion and Next Steps

For expatriates and international investors with assets particularly in the UAE, a DIFC Financial Assets Will provides secure, efficient, and compliant legacy management. By leveraging the legal framework of DIFC, individuals can ensure their assets are allocated according to their wishes, free from the complications of local inheritance laws. Protect your investments today with a DIFC Financial Assets Will.

Ready to Secure Your Financial Future?

Contact us now to begin crafting your personalized DIFC Financial Assets Will, securing the future of your assets and giving peace of mind to your beneficiaries.

Have Additional Questions?

- 2101, 21st Floor, The Binary By Omniyat, Business Bay, Dubai, UAE

- +971 50 504 6703

- info@juriszone.com

DIFC Full Wills

If you want a will that includes both asset distribution and guardianship provisions, register a Full Will.

DIFC Property Wills

Non-Muslims can register a “Property Will” with the DIFC Courts for their real estate assets.

DIFC Business Owners Wills

Non-Muslims can register a “Business Owners Will” with the DIFC Courts for who own shares in UAE-based companies.

DIFC Guardianship Wills

Non-Muslims with minor children can use the DIFC Courts to register a “Guardianship Will.”

DIFC Digital Assets Will

Non-Muslims can register a “Digital Assets Will” allows the testator to store their digital assets in a non-custodial wallet.”