DIFC Business Owners Will Services: Protecting Your Business Interests in Dubai

Creating a will that secures your business interests in Dubai International Financial Centre (DIFC) is crucial for legacy protection and peace of mind. DIFC Business Owners Wills are customized to meet the unique needs of non-Muslim business owners in order to distribute their assets in the UAE. Whether you’re a company founder or a major shareholder, our service ensures your company shares are managed and distributed according to your wishes, eliminating ambiguity and potential conflicts.

What is a DIFC Business Owners Will?

A DIFC Business Owners Will is a legally binding document specifically designed for non-Muslim individuals with business assets in the UAE. It provides a structured framework for:

- Company Shares – Facilitates the distribution of shares in UAE-registered companies, including any related dividends and bonuses.

- Executor Appointments – Assign a trusted individual to manage the execution of your will and distribution of your assets.

- Exclusive DIFC Jurisdiction – Grants the DIFC courts sole authority to interpret and enforce your will, adding an extra layer of security under UAE federal law.

This will can only be created through the DIFC Wills Service Centre (www.difcwills.ae), where you’ll declare your intentions, list your company shares, and assign beneficiaries to receive your assets.

Key Elements of a DIFC Business Owners Will

- Declaration of Non-Muslim Status – DIFC Business Owners Wills are available exclusively for non-Muslim individuals, ensuring that the will’s provisions follow secular principles and are not subject to Sharia law.

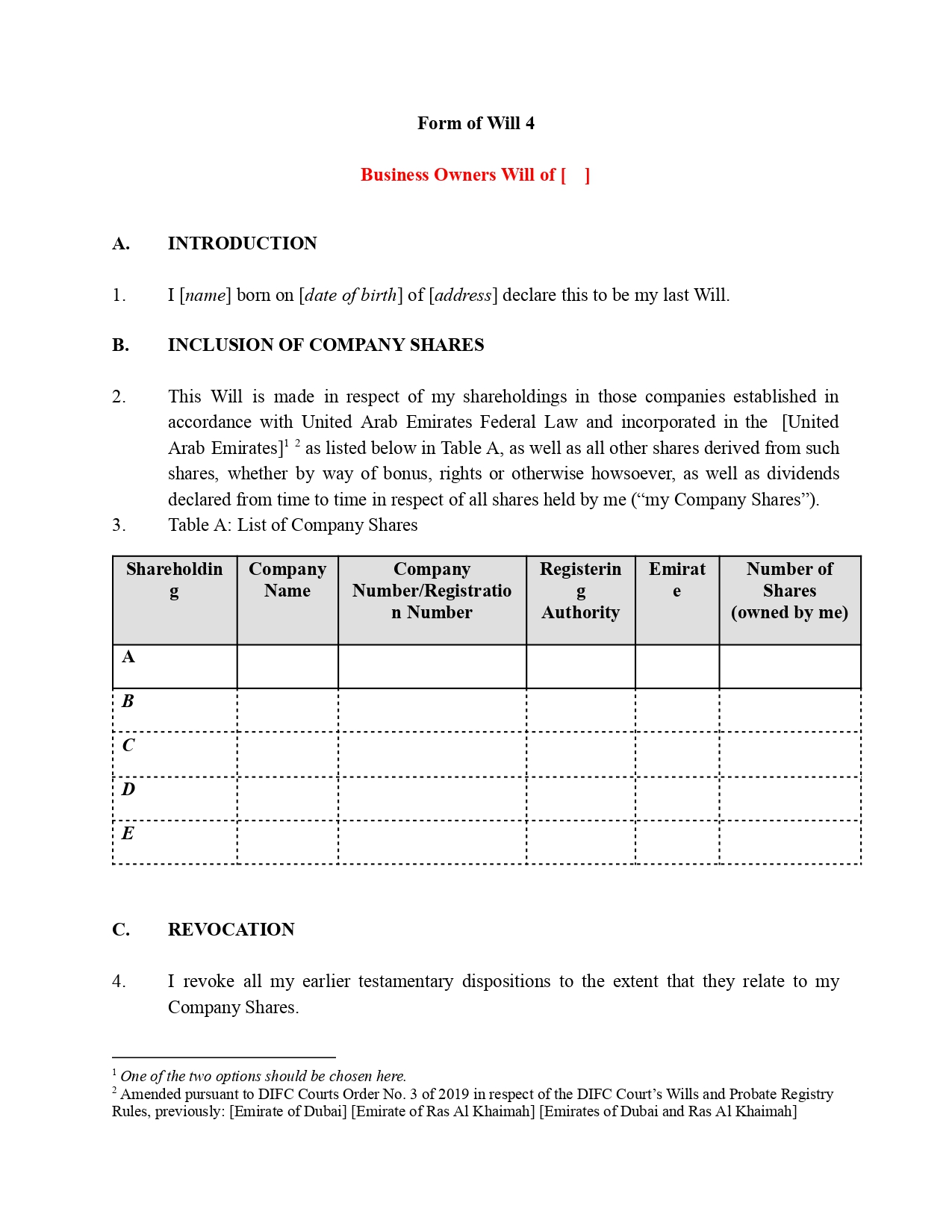

- Shareholding Details – The will enables business owners to detail each company shareholding, specifying quantities, registration numbers, and the designated registering authority for each Emirate. This clarity prevents disputes and provides beneficiaries with an exact inheritance plan.

- Revocation of Prior Dispositions – Upon executing a DIFC Business Owners Will, any prior will gets revoked. This revocation grants full authority to the current will, eliminating confusion over asset distribution.

- Appointment of Executors – You’ll assign a primary executor to manage your assets and, if needed, an alternate executor. These individuals singly or jointly are empowered to administer your shares and ensure the beneficiaries inherit according to your instructions.

- Distribution of Shares to Beneficiaries – The will specifies each beneficiary’s share portion and includes provisions for substitute beneficiaries if primary beneficiaries are unable to inherit. This setup guarantees the orderly transfer of assets.

- Governing Law and DIFC Jurisdiction – The DIFC law, under Dubai Law No. 12 of 2004, governs the will’s validity and execution. DIFC courts are granted exclusive jurisdiction to manage proceedings related to the will, adding assurance to your asset distribution.

Connect With Our Experts Will Draftsmen

Reach out to our experts for guidance on drafting your will fill out the form below to get in touch.

Why Choose a DIFC Business Owners Will?

A DIFC Business Owners Will is uniquely suited for protecting company shares, dividends, and bonuses related to UAE-registered companies. It provides:

- Clear Succession Planning – The will details specific transfer instructions, providing peace of mind that your business interests will be smoothly passed on to chosen beneficiaries.

- Exclusive Legal Security – DIFC Business Owners Will ensures all decisions related to the will are managed according to the DIFC Wills and Probate Rules.

- Simplified Asset Management – Executors and trustees gain legal authority over designated assets, reducing administrative burdens and costs.

The DIFC Wills Service Centre offers a dedicated, reliable platform for non-Muslim business owners to secure their business interests in the UAE, ensuring your legacy is protected.

How to Set Up Your DIFC Business Owners Will

- Prepare Your Company Share Details – Gather information on your company shares, including the company name, registration number, and Emirate authority.

- Choose Your Executors – Select a trusted individual as your primary executor and, if needed, an alternate. These individuals will manage asset administration according to your will’s terms.

- List Your Beneficiaries and Substitutes – Decide on the distribution of your shares and name substitute beneficiaries to ensure uninterrupted inheritance.

- Complete the Will Online at DIFC Wills Service Centre – The DIFC Wills Service Centre’s online portal offers a streamlined process for completing your DIFC Business Owners Will, accessible at www.difcwills.ae.

FAQ

Conclusion: Secure Your Business Legacy with a DIFC Will

Have Additional Questions?

- 2101, 21st Floor, The Binary By Omniyat, Business Bay, Dubai, UAE

- +971 50 504 6703

- info@juriszone.com

DIFC Full Wills

If you want a will that includes both asset distribution and guardianship provisions, register a Full Will.

DIFC Property Wills

Non-Muslims can register a “Property Will” with the DIFC Courts for their real estate assets.

DIFC Financial Assets Wills

Non-Muslims can register a “Financial Assets Will” with the DIFC Courts for their bank and brokerage accounts.

DIFC Guardianship Wills

Non-Muslims with minor children can use the DIFC Courts to register a “Guardianship Will.”

DIFC Digital Assets Will

Non-Muslims can register a “Digital Assets Will” allows the testator to store their digital assets in a non-custodial wallet.”