The DIFC Active Enterprise license lets businesses operate in Dubai’s financial center.

The Active Enterprise license supports multiple business activities. Businesses can offer professional services. Commercial firms can conduct business operations through holding companies.

There is zero corporate tax on profits, so business owners can move money freely. The location offers easy access to Middle Eastern markets.

This guide shows the exact steps to get a DIFC license. You will learn the costs, requirements, and processes. We explain the permitted activities and compliance rules. The guide helps you make informed business decisions.

What is a DIFC Active Enterprise?

An active enterprise can be used for holding companies, managing offices, and proprietary investment activities.

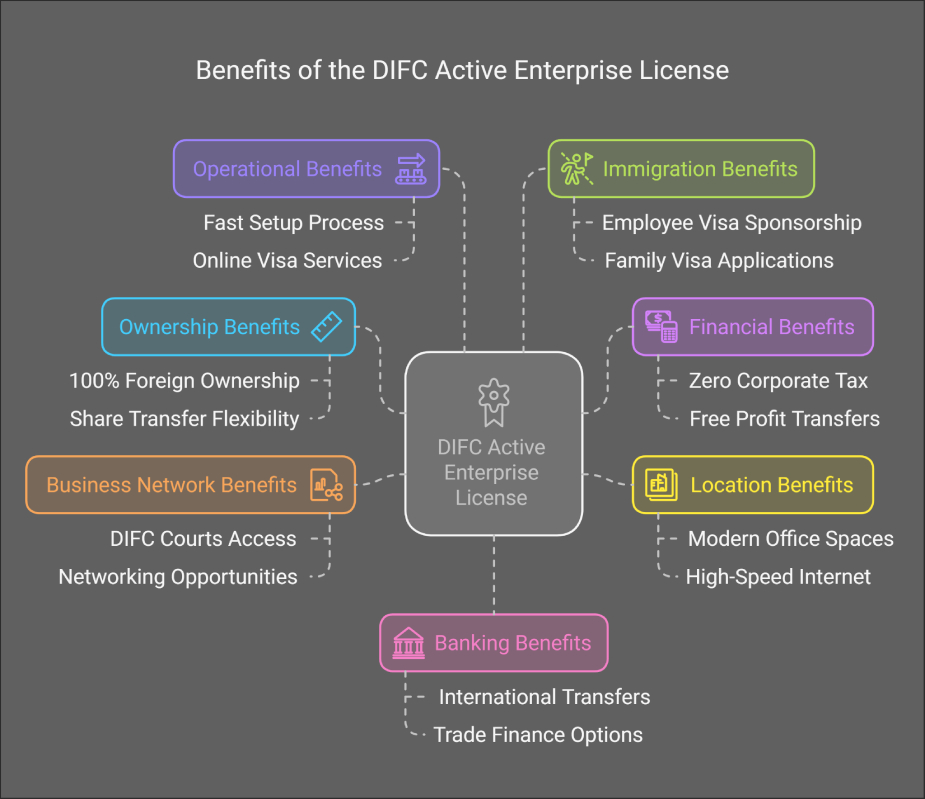

Benefits and Advantages of the DIFC Active Enterprise License

The DIFC Active Enterprise license offers a range of clear business benefits, providing companies with specific advantages when operating within the Dubai International Financial Centre (DIFC).

1. Ownership Benefits

Businesses enjoy 100% foreign ownership without the need for a local sponsor, giving them full control over their operations. Companies can freely transfer shares, ensuring flexibility in ownership structures.

2. Tax Benefits

The license offers significant financial advantages, including zero corporate tax and no income tax,. Businesses benefit from free profit transfers and USD-based operations, making international transactions seamless.

3. Location Benefits

Operating in DIFC provides a prestigious Dubai address with access to modern office spaces, high-speed internet, business centers, and meeting facilities. This prime location enhances a company’s credibility and business presence.

4. Business Network Benefits

Companies gain access to DIFC courts, strong banking connections, legal service providers, and a vibrant business community. Regular networking events offer opportunities to build valuable partnerships.

5. Operational Benefits

Setting up a company is fast and straightforward with a simple renewal process. Businesses can manage online visa services, access 24/7 support, and benefit from quick document processing, ensuring smooth daily operations.

6. Immigration Benefits

The license allows companies to sponsor employee visas, apply for family visas, and secure multiple entry permits. The visa processing system is efficient, enabling quick approvals for both staff and dependents.

7. Banking Benefits

Businesses can open DIFC bank accounts, conduct international transfers, manage multiple currencies, and access online banking services. Trade finance options further support business growth and global operations.

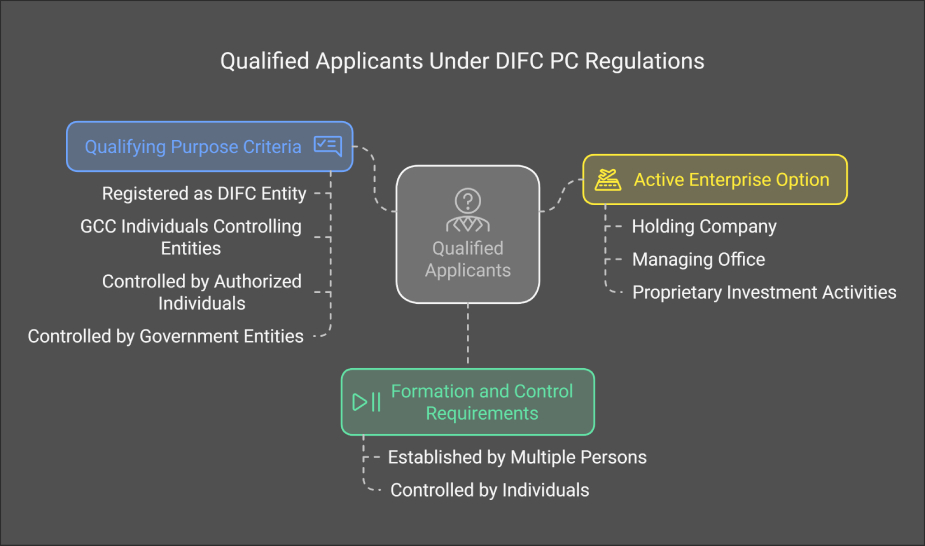

Who Qualifies for a DIFC Active Enterprise?

To obtain a DIFC Active Enterprise license, companies must meet specific eligibility criteria and structural requirements. These conditions ensure businesses comply with the regulatory framework of the Dubai International Financial Centre (DIFC).

A DIFC Active Enterprise can be established by a qualifying applicant. The following entities qualify:

- DIFC Registered Entity (excluding a Prescribed Company, NPIO, or Foundation).

- Controlling shareholder or UBO of a DIFC Registered Entity (excluding a Prescribed Company, NPIO, or Foundation).

- Ultimate beneficial owner controlling a DIFC-registered entity.

- Family Operated Business meeting DIFC Family Arrangement Regulations with a strong presence in the UAE.

- UAE/Emirate Government Entity or an entity at least 25% owned (directly or indirectly) or controlled by a UAE/Emirate Government Entity.

Definitions and Criteria

Government Entity

A government entity includes:

- The Federal Government, the government of Dubai, or the government of any Emirate.

- A person or entity in which a government entity listed above owns at least 25% (directly or indirectly) or is otherwise controlled by such a government entity.

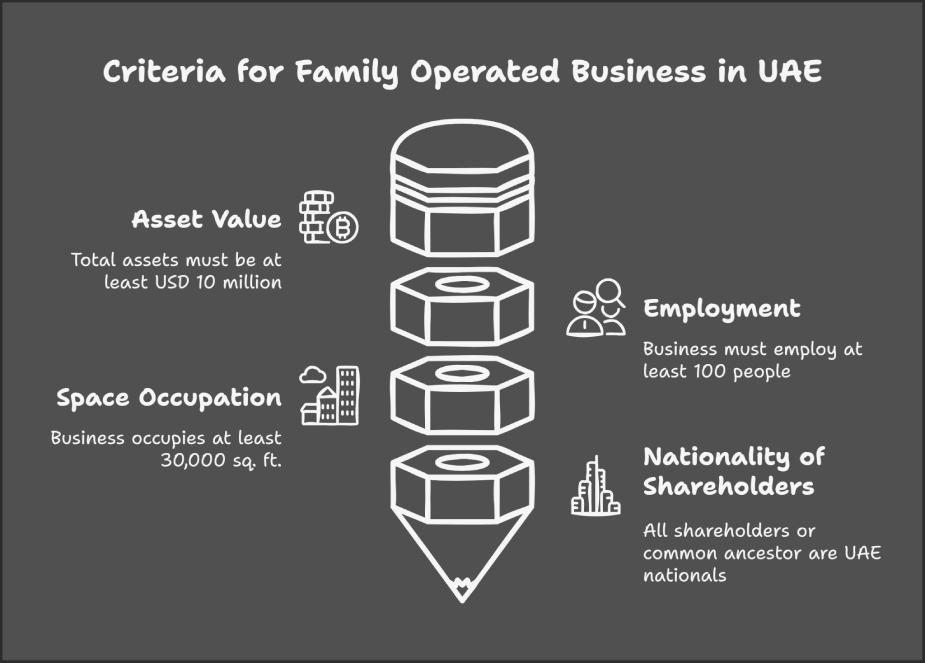

Family Operated Business with a Large Presence in the UAE

A family-operated business qualifies if it meets the definition of a “Family” under the Family Arrangement Regulations and satisfies at least two of the following criteria:

- Total asset value of at least USD 10 million.

- Employs at least 100 people.

- Occupies at least 30,000 sq. ft. of space in the UAE (e.g., offices, retail, schools, manufacturing facilities).

- All shareholders are UAE nationals, or the common ancestor of the business is a UAE national.

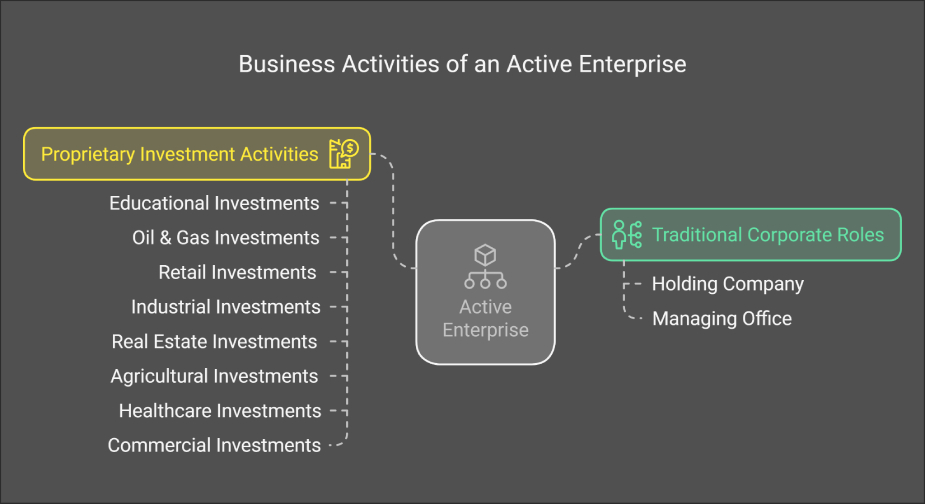

2. What business activities can an Active Enterprise carry out?

An active enterprise can be used for holding companies, managing offices, and proprietary investment activities.

A. Holding Company

- Acting as a Holding Company – managing and controlling shareholdings or investments across other subsidiaries.

B. Managing Office

- Overseeing and coordinating the administrative, operational, or strategic functions of affiliated companies.

B. Proprietary Investment Activities

An Active Enterprise can directly undertake proprietary investments. Examples of permitted investment activities include:

- Investment in Educational Enterprises & Management

- Investment in Oil & Natural Gas Projects

- Investment in Retail Trade Enterprises & Management

- Investment in Industrial Enterprises & Management

- Investment in Real Estate

- Investment in Agricultural Enterprises & Management

- Investment in Healthcare Enterprises & Development

- Investment in Commercial Enterprises & Management

DIFC Active Enterprise License – Documentation Checklist

For individual applicants:

- Valid passport copy

- Recent photograph

- Bank statement

- CV or resume

- Proof of address

- UAE visa copy (if applicable)

For corporate applicants:

- Company registration certificate

- Board resolution

- Company profile

- Bank statements

- Ownership structure details

- Other relevant corporate documents

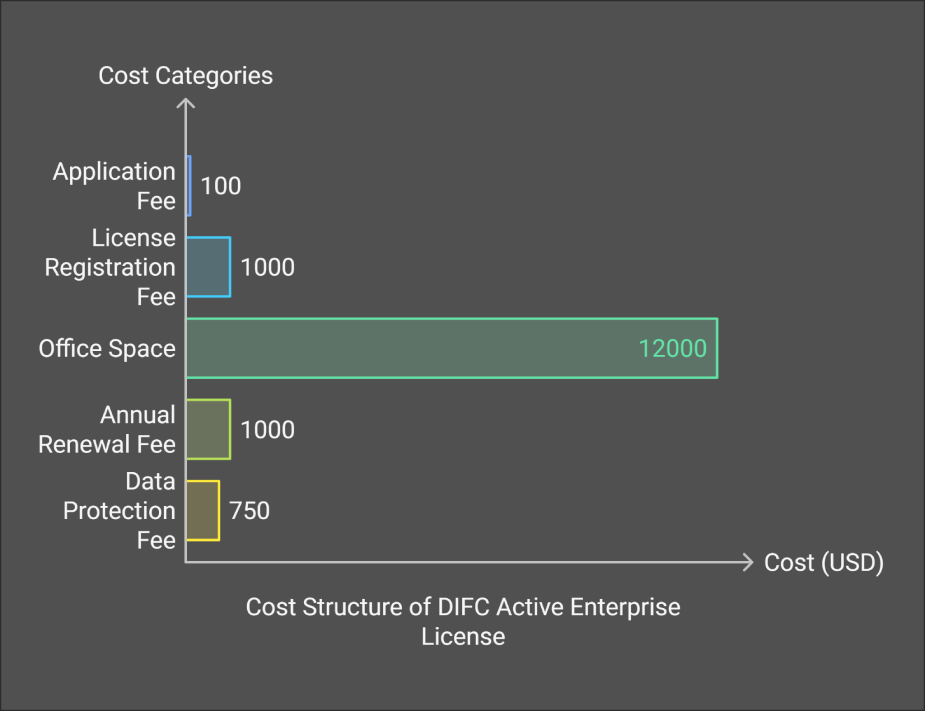

Cost Structure for the DIFC Active Enterprise License

The DIFC Active Enterprise license has a defined cost structure that includes fees for initial setup, annual renewals, and optional services. Companies must budget for these costs to start and maintain operations within the Dubai International Financial Centre (DIFC).

Initial Setup Costs:

To establish a business in DIFC, companies must pay the application fee. The application fee is USD 100 and the ACTIVE Enterprise License registration fee of USD 1,000.

Office Costs:

Businesses must secure office space within DIFC, and the cost depends on the office space requirement starting from USD 12,000.

Annual Renewal Costs:

An annual commercial license fee of USD 1000 must be paid for DIFC Active Enterprise’s renewal.

Data protection fees:

USD 750 – if applicable.

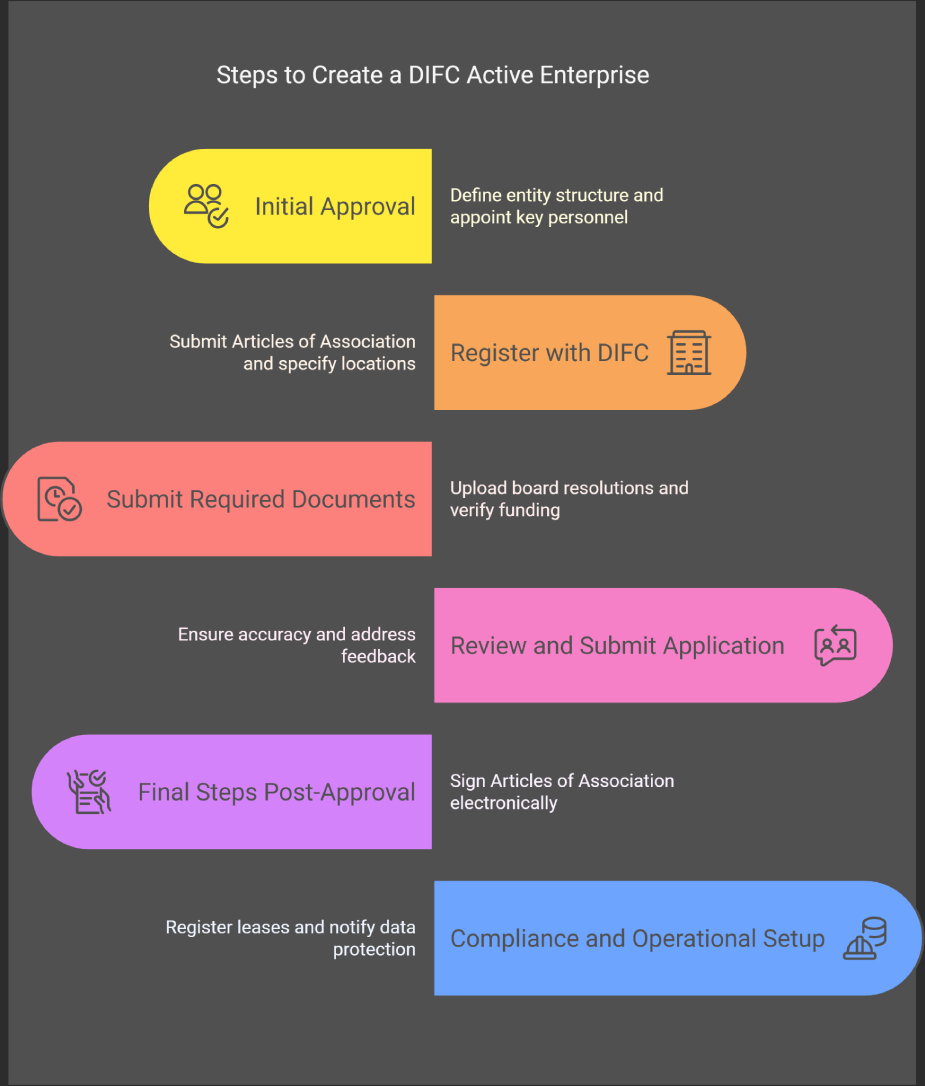

Steps to Create a DIFC Active Enterprise

1. Initial Approval

- Define the entity structure (e.g., Non-Financial, Prescribed Companies, Private Company).

- Select qualifying requirements (e.g., GCC control, authorized firms, or qualifying purposes).

- Provide required documents such as passport copies, CVs, and certificates of incorporation.

- Choose a company name and reserve it if needed.

- Appoint shareholders, directors, and corporate service providers (if applicable).

- Allocate shares and define share classes.

1

2. Register with DIFC

- Prepare and submit Articles of Association (standard or modified).

- Specify the registered address and operating locations.

- Identify key personnel such as company secretary (optional), authorized signatories, and management contacts.

- Complete a data protection notification if personal data will be processed.

2

3. Submit Required Documents

- Upload board resolutions authorizing incorporation.

- Provide certified passport copies for shareholders, directors, and signatories.

- Submit financial statements or bank statements to verify funding sources.

- Include additional documents like organizational charts or structural diagrams if applicable.

3

Step 4: Review and Submit Application

- Ensure all information is accurate and complete before submission.

- Address any feedback or requests for additional information from DIFC Services.

4

5. Final Steps Post-Approval

- Sign Articles of Association electronically (if applicable).

5

6. Compliance and Operational Setup

- Register leases or office agreements with DIFC Registrar of Real Property.

- Notify the Commissioner of Data Protection about personal data processing within six months if applicable.

6

Frequently Asked Questions About DIFC Active Enterprise

Eligibility Questions

You must be a DIFC-registered entity, a government entity, or a family-owned business to apply for DIFC Active Enterprise.

No. Foreign applicants can apply. The license helps get UAE residence after approval.